We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of BancorpSouth Bank (NYSE:BXS) based on that data.

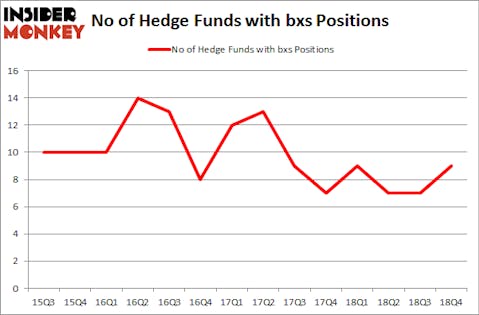

Is BancorpSouth Bank (NYSE:BXS) a splendid investment today? The smart money is in a bullish mood. The number of bullish hedge fund bets went up by 2 in recent months. Our calculations also showed that bxs isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are perceived as slow, old financial vehicles of years past. While there are over 8000 funds in operation at present, Our researchers choose to focus on the masters of this club, approximately 750 funds. These hedge fund managers administer the lion’s share of the smart money’s total capital, and by watching their first-class investments, Insider Monkey has found a few investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a look at the new hedge fund action encompassing BancorpSouth Bank (NYSE:BXS).

How have hedgies been trading BancorpSouth Bank (NYSE:BXS)?

At Q4’s end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 29% from one quarter earlier. On the other hand, there were a total of 9 hedge funds with a bullish position in BXS a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Fisher Asset Management held the most valuable stake in BancorpSouth Bank (NYSE:BXS), which was worth $29.9 million at the end of the third quarter. On the second spot was Balyasny Asset Management which amassed $17.4 million worth of shares. Moreover, Renaissance Technologies, Citadel Investment Group, and Laurion Capital Management were also bullish on BancorpSouth Bank (NYSE:BXS), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, assembled the biggest position in BancorpSouth Bank (NYSE:BXS). Renaissance Technologies had $3.4 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $1.5 million position during the quarter. The following funds were also among the new BXS investors: Benjamin A. Smith’s Laurion Capital Management and Matthew Tewksbury’s Stevens Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as BancorpSouth Bank (NYSE:BXS) but similarly valued. These stocks are Vishay Intertechnology, Inc. (NYSE:VSH), Smartsheet Inc. (NYSE:SMAR), Cabot Corporation (NYSE:CBT), and Weight Watchers International, Inc. (NASDAQ:WTW). This group of stocks’ market valuations resemble BXS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VSH | 19 | 333325 | -3 |

| SMAR | 17 | 186129 | 6 |

| CBT | 29 | 124001 | 5 |

| WTW | 23 | 140552 | -8 |

| Average | 22 | 196002 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $196 million. That figure was $55 million in BXS’s case. Cabot Corporation (NYSE:CBT) is the most popular stock in this table. On the other hand Smartsheet Inc. (NYSE:SMAR) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks BancorpSouth Bank (NYSE:BXS) is even less popular than SMAR. Hedge funds dodged a bullet by taking a bearish stance towards BXS. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BXS wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); BXS investors were disappointed as the stock returned 13.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.