Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

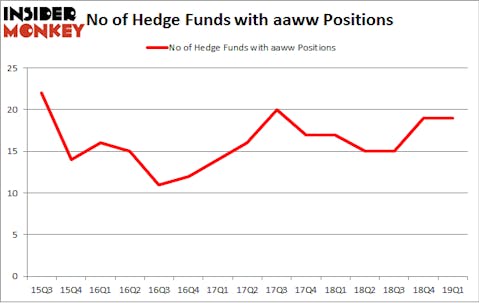

Atlas Air Worldwide Holdings, Inc. (NASDAQ:AAWW) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 19 hedge funds’ portfolios at the end of March. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Realogy Holdings Corp (NYSE:RLGY), Avon Products, Inc. (NYSE:AVP), and Natera Inc (NASDAQ:NTRA) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the recent hedge fund action encompassing Atlas Air Worldwide Holdings, Inc. (NASDAQ:AAWW).

What have hedge funds been doing with Atlas Air Worldwide Holdings, Inc. (NASDAQ:AAWW)?

At Q1’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 17 hedge funds with a bullish position in AAWW a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the number one position in Atlas Air Worldwide Holdings, Inc. (NASDAQ:AAWW). Fisher Asset Management has a $25.2 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Millennium Management, managed by Israel Englander, which holds a $16.5 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that are bullish include Israel Englander’s Millennium Management, Chuck Royce’s Royce & Associates and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Due to the fact that Atlas Air Worldwide Holdings, Inc. (NASDAQ:AAWW) has experienced declining sentiment from the smart money, it’s easy to see that there were a few hedge funds that slashed their positions entirely in the third quarter. It’s worth mentioning that Mariko Gordon’s Daruma Asset Management sold off the largest stake of all the hedgies watched by Insider Monkey, valued at close to $22.6 million in stock. Daniel S. Och’s fund, OZ Management, also sold off its stock, about $20.7 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Atlas Air Worldwide Holdings, Inc. (NASDAQ:AAWW). We will take a look at Realogy Holdings Corp (NYSE:RLGY), Avon Products, Inc. (NYSE:AVP), Natera Inc (NASDAQ:NTRA), and First Majestic Silver Corp (NYSE:AG). All of these stocks’ market caps match AAWW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RLGY | 28 | 441695 | 8 |

| AVP | 22 | 260384 | -2 |

| NTRA | 18 | 154179 | 1 |

| AG | 8 | 8553 | -2 |

| Average | 19 | 216203 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $216 million. That figure was $126 million in AAWW’s case. Realogy Holdings Corp (NYSE:RLGY) is the most popular stock in this table. On the other hand First Majestic Silver Corp (NYSE:AG) is the least popular one with only 8 bullish hedge fund positions. Atlas Air Worldwide Holdings, Inc. (NASDAQ:AAWW) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately AAWW wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); AAWW investors were disappointed as the stock returned -25.3% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.