ClearBridge Investments, an investment management company, released its “ClearBridge International Growth EAFE Strategy” fourth quarter 2023 investor letter. A copy of the same can be downloaded here. Holdings in Europe and the United Kingdom made significant contributions to the Strategy’s performance, which exceeded its benchmark, the MSCI EAFE Index. The strategy generated gains across nine of the ten sectors in which it was invested during the quarter, on an absolute basis. Overall sector allocation contributed to the performance on a relative basis. In addition, please check the fund’s top five holdings to know its best picks in 2023.

ClearBridge International Growth EAFE Strategy featured stocks such as ASML Holding N.V. (NASDAQ:ASML) in the fourth quarter 2023 investor letter. Headquartered in Veldhoven, the Netherlands, ASML Holding N.V. (NASDAQ:ASML) develops, produces, and markets advanced semiconductor equipment systems. On January 8, 2024, ASML Holding N.V. (NASDAQ:ASML) stock closed at $720.84 per share. One-month return of ASML Holding N.V. (NASDAQ:ASML) was 0.04%, and its shares gained 13.81% of their value over the last 52 weeks. ASML Holding N.V. (NASDAQ:ASML) has a market capitalization of $284.436 billion.

ClearBridge International Growth EAFE Strategy stated the following regarding ASML Holding N.V. (NASDAQ:ASML) in its fourth quarter 2023 investor letter:

“Another welcome change has been the recognition of generative artificial intelligence (AI) opportunities for companies outside the U.S. While our IT holdings trailed their mega cap U.S. counterparts for most of the year, semiconductor equipment makers ASML Holding N.V. (NASDAQ:ASML) and Tokyo Electron, which we consider enablers of AI, as well as enterprise software maker SAP and IT consultant Accenture, which we see as facilitators of AI adoption in new product lines and/or enhanced business models, rose strongly in the quarter. These companies are rolling out new, AI-enhanced products at higher prices which should positively impact earnings in the near term.

On an individual stock basis, the largest contributors to absolute returns in the quarter included ASML and Tokyo Electron in the IT sector.”

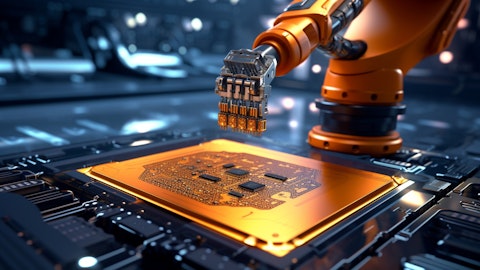

A technician in a clean room working on a semiconductor device, illuminated by the machines.

ASML Holding N.V. (NASDAQ:ASML) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 57 hedge fund portfolios held ASML Holding N.V. (NASDAQ:ASML) at the end of third quarter which was 55 in the previous quarter.

We discussed ASML Holding N.V. (NASDAQ:ASML) in another article and shared the list of money-making stocks to invest in. In addition, please check out our hedge fund investor letters Q4 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 17 High Growth Non-Tech Stocks That Are Profitable

- Best Car Accident and Personal Injury Lawyers in Each of 30 Biggest Cities in the US

- Wall Street Analysts Just Trimmed Price Targets for These 10 Stocks

Disclosure: None. This article is originally published at Insider Monkey.