Is ArcelorMittal (NYSE:MT) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

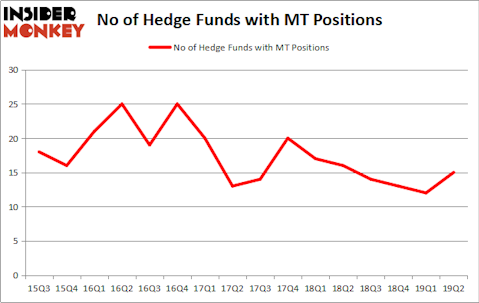

ArcelorMittal (NYSE:MT) has seen an increase in enthusiasm from smart money recently. MT was in 15 hedge funds’ portfolios at the end of the second quarter of 2019. There were 12 hedge funds in our database with MT holdings at the end of the previous quarter. Our calculations also showed that MT isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are plenty of tools stock market investors employ to evaluate stocks. A couple of the most useful tools are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the best investment managers can outclass the broader indices by a healthy amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a gander at the fresh hedge fund action surrounding ArcelorMittal (NYSE:MT).

What have hedge funds been doing with ArcelorMittal (NYSE:MT)?

Heading into the third quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the first quarter of 2019. By comparison, 16 hedge funds held shares or bullish call options in MT a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jonathan Barrett and Paul Segal’s Luminus Management has the most valuable position in ArcelorMittal (NYSE:MT), worth close to $67.2 million, accounting for 1.6% of its total 13F portfolio. Coming in second is Highline Capital Management, led by Jacob Doft, holding a $56.1 million position; 4.1% of its 13F portfolio is allocated to the company. Other members of the smart money that are bullish contain Ken Griffin’s Citadel Investment Group, Renaissance Technologies and Dmitry Balyasny’s Balyasny Asset Management.

As one would reasonably expect, key hedge funds were breaking ground themselves. Highline Capital Management, managed by Jacob Doft, established the biggest position in ArcelorMittal (NYSE:MT). Highline Capital Management had $56.1 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $4 million investment in the stock during the quarter. The other funds with brand new MT positions are Steve Cohen’s Point72 Asset Management, Matthew Hulsizer’s PEAK6 Capital Management, and Clint Carlson’s Carlson Capital.

Let’s now take a look at hedge fund activity in other stocks similar to ArcelorMittal (NYSE:MT). We will take a look at CBRE Group, Inc. (NYSE:CBRE), Lyft, Inc. (NASDAQ:LYFT), International Paper Company (NYSE:IP), and Twilio Inc. (NYSE:TWLO). This group of stocks’ market values are closest to MT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBRE | 25 | 1293555 | -6 |

| LYFT | 37 | 1788821 | -34 |

| IP | 31 | 256587 | 2 |

| TWLO | 63 | 2265236 | 4 |

| Average | 39 | 1401050 | -8.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39 hedge funds with bullish positions and the average amount invested in these stocks was $1401 million. That figure was $247 million in MT’s case. Twilio Inc. (NYSE:TWLO) is the most popular stock in this table. On the other hand CBRE Group, Inc. (NYSE:CBRE) is the least popular one with only 25 bullish hedge fund positions. Compared to these stocks ArcelorMittal (NYSE:MT) is even less popular than CBRE. Hedge funds dodged a bullet by taking a bearish stance towards MT. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MT wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); MT investors were disappointed as the stock returned -21% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.