Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Arbor Realty Trust, Inc. (NYSE:ABR), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

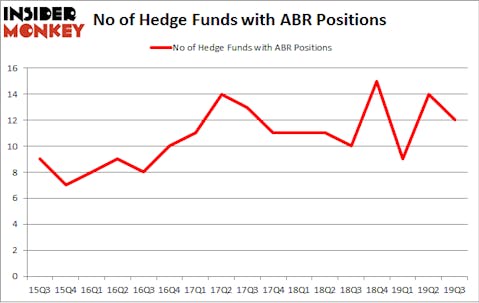

Is Arbor Realty Trust, Inc. (NYSE:ABR) ready to rally soon? The best stock pickers are getting less bullish. The number of long hedge fund positions retreated by 2 lately. Our calculations also showed that ABR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). ABR was in 12 hedge funds’ portfolios at the end of September. There were 14 hedge funds in our database with ABR positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Leon Cooperman of Omega Advisors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the latest hedge fund action regarding Arbor Realty Trust, Inc. (NYSE:ABR).

How are hedge funds trading Arbor Realty Trust, Inc. (NYSE:ABR)?

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of -14% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in ABR over the last 17 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Leon Cooperman’s Omega Advisors has the most valuable position in Arbor Realty Trust, Inc. (NYSE:ABR), worth close to $32.2 million, amounting to 1.9% of its total 13F portfolio. Coming in second is Millennium Management, managed by Israel Englander, which holds a $19.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism encompass Paul Marshall and Ian Wace’s Marshall Wace, Ken Griffin’s Citadel Investment Group and Louis Navellier’s Navellier & Associates. In terms of the portfolio weights assigned to each position Omega Advisors allocated the biggest weight to Arbor Realty Trust, Inc. (NYSE:ABR), around 1.91% of its 13F portfolio. Navellier & Associates is also relatively very bullish on the stock, designating 0.98 percent of its 13F equity portfolio to ABR.

Due to the fact that Arbor Realty Trust, Inc. (NYSE:ABR) has faced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there was a specific group of fund managers who were dropping their full holdings heading into Q4. Interestingly, Dmitry Balyasny’s Balyasny Asset Management sold off the biggest position of the “upper crust” of funds watched by Insider Monkey, totaling an estimated $7.8 million in stock. Donald Sussman’s fund, Paloma Partners, also said goodbye to its stock, about $3.6 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 2 funds heading into Q4.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Arbor Realty Trust, Inc. (NYSE:ABR) but similarly valued. These stocks are Meta Financial Group Inc. (NASDAQ:CASH), Designer Brands Inc. (NYSE:DBI), Safehold Inc. (NYSE:SAFE), and G-III Apparel Group, Ltd. (NASDAQ:GIII). This group of stocks’ market values are similar to ABR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CASH | 14 | 127610 | 2 |

| DBI | 19 | 115186 | 3 |

| SAFE | 8 | 11924 | 5 |

| GIII | 12 | 80887 | -1 |

| Average | 13.25 | 83902 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $84 million. That figure was $100 million in ABR’s case. Designer Brands Inc. (NYSE:DBI) is the most popular stock in this table. On the other hand Safehold Inc. (NYSE:SAFE) is the least popular one with only 8 bullish hedge fund positions. Arbor Realty Trust, Inc. (NYSE:ABR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on ABR as the stock returned 18% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.