We know that hedge funds generate strong, risk-adjusted returns over the long run, which is why imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, professional investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do. However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, let’s examine the smart money sentiment towards American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) and determine whether hedge funds skillfully traded this stock.

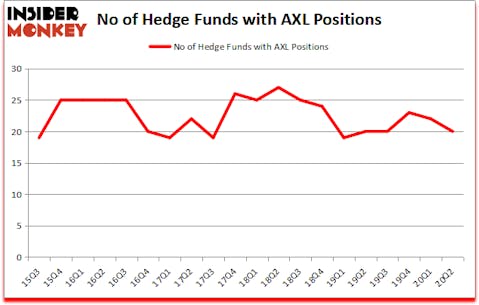

Is American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) worth your attention right now? Hedge funds were taking a pessimistic view. The number of bullish hedge fund bets fell by 2 lately. American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) was in 20 hedge funds’ portfolios at the end of June. The all time high for this statistics is 27. Our calculations also showed that AXL isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 22 hedge funds in our database with AXL positions at the end of the first quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Andy Redleaf of Whitebox Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we are checking out this junior gold mining stock and we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox.Now we’re going to review the fresh hedge fund action surrounding American Axle & Manufacturing Holdings, Inc. (NYSE:AXL).

Hedge fund activity in American Axle & Manufacturing Holdings, Inc. (NYSE:AXL)

At the end of the second quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the first quarter of 2020. By comparison, 20 hedge funds held shares or bullish call options in AXL a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) was held by D E Shaw, which reported holding $15.1 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $14.5 million position. Other investors bullish on the company included Arrowstreet Capital, Redwood Capital Management, and Whitebox Advisors. In terms of the portfolio weights assigned to each position Redwood Capital Management allocated the biggest weight to American Axle & Manufacturing Holdings, Inc. (NYSE:AXL), around 0.9% of its 13F portfolio. Jade Capital Advisors is also relatively very bullish on the stock, setting aside 0.75 percent of its 13F equity portfolio to AXL.

Since American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) has witnessed falling interest from hedge fund managers, it’s safe to say that there is a sect of fund managers that decided to sell off their positions entirely in the second quarter. Intriguingly, Mike Vranos’s Ellington cut the biggest investment of the “upper crust” of funds tracked by Insider Monkey, comprising close to $2.8 million in stock, and Kevin Michael Ulrich and Anthony Davis’s Anchorage Advisors was right behind this move, as the fund cut about $1.8 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 2 funds in the second quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) but similarly valued. These stocks are Precigen, Inc. (NASDAQ:PGEN), NextPoint Residential Trust Inc (NYSE:NXRT), Atara Biotherapeutics Inc (NASDAQ:ATRA), Piper Sandler Companies (NYSE:PIPR), Primoris Services Corp (NASDAQ:PRIM), nLIGHT, Inc. (NASDAQ:LASR), and Applied Molecular Transport Inc. (NASDAQ:AMTI). This group of stocks’ market valuations match AXL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PGEN | 15 | 53978 | 2 |

| NXRT | 13 | 69108 | 2 |

| ATRA | 22 | 523096 | 5 |

| PIPR | 13 | 34068 | 1 |

| PRIM | 19 | 74332 | 8 |

| LASR | 12 | 58428 | 5 |

| AMTI | 8 | 70617 | 8 |

| Average | 14.6 | 126232 | 4.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.6 hedge funds with bullish positions and the average amount invested in these stocks was $126 million. That figure was $73 million in AXL’s case. Atara Biotherapeutics Inc (NASDAQ:ATRA) is the most popular stock in this table. On the other hand Applied Molecular Transport Inc. (NASDAQ:AMTI) is the least popular one with only 8 bullish hedge fund positions. American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for AXL is 25.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 24.8% in 2020 through the end of September and beat the market by 19.3 percentage points. Unfortunately AXL wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on AXL were disappointed as the stock returned -24.1% in Q3 and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Dauch Corp (NYSE:DCH)

Follow Dauch Corp (NYSE:DCH)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.