How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG).

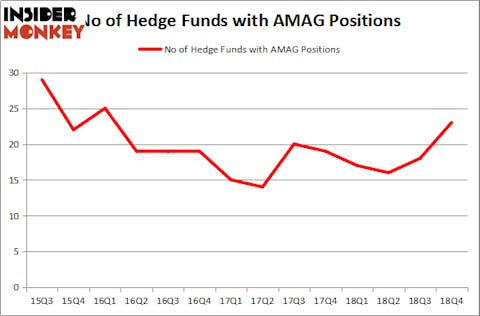

AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG) investors should be aware of an increase in hedge fund sentiment recently. AMAG was in 23 hedge funds’ portfolios at the end of December. There were 18 hedge funds in our database with AMAG positions at the end of the previous quarter. Our calculations also showed that AMAG isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are dozens of metrics shareholders have at their disposal to size up their holdings. A pair of the best metrics are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can outpace their index-focused peers by a solid margin (see the details here).

We’re going to take a look at the fresh hedge fund action surrounding AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG).

Hedge fund activity in AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG)

At Q4’s end, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 28% from the second quarter of 2018. By comparison, 17 hedge funds held shares or bullish call options in AMAG a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, William Leland Edwards’s Palo Alto Investors has the largest position in AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG), worth close to $51.4 million, comprising 2.7% of its total 13F portfolio. Coming in second is Camber Capital Management, led by Stephen DuBois, holding a $40.3 million position; the fund has 1.9% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions include Steven Boyd’s Armistice Capital, Jim Simons’s Renaissance Technologies and D. E. Shaw’s D E Shaw.

Now, some big names have been driving this bullishness. Great Point Partners, managed by Jeffrey Jay and David Kroin, established the largest position in AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG). Great Point Partners had $10.1 million invested in the company at the end of the quarter. Michael A. Price and Amos Meron’s Empyrean Capital Partners also made a $4.1 million investment in the stock during the quarter. The following funds were also among the new AMAG investors: Cliff Asness’s AQR Capital Management, Benjamin A. Smith’s Laurion Capital Management, and Peter Muller’s PDT Partners.

Let’s now take a look at hedge fund activity in other stocks similar to AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG). These stocks are The Manitowoc Company, Inc. (NYSE:MTW), Tredegar Corporation (NYSE:TG), Collier Creek Holdings (NYSE:CCH), and Diamond Hill Investment Group, Inc. (NASDAQ:DHIL). All of these stocks’ market caps resemble AMAG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTW | 14 | 94039 | -7 |

| TG | 11 | 68099 | -1 |

| CCH | 16 | 139762 | 16 |

| DHIL | 7 | 40494 | 0 |

| Average | 12 | 85599 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $86 million. That figure was $202 million in AMAG’s case. Collier Creek Holdings (NYSE:CCH) is the most popular stock in this table. On the other hand Diamond Hill Investment Group, Inc. (NASDAQ:DHIL) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately AMAG wasn’t nearly as popular as these 15 stock and hedge funds that were betting on AMAG were disappointed as the stock returned -21.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.