Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and a 20% drop in stock prices. Things completely reversed in 2019 and stock indices hit record highs. Recent hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Alpine Immune Sciences, Inc. (NASDAQ:ALPN) to find out whether it was one of their high conviction long-term ideas.

Alpine Immune Sciences, Inc. (NASDAQ:ALPN) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 6 hedge funds’ portfolios at the end of the third quarter of 2019. At the end of this article we will also compare ALPN to other stocks including Neos Therapeutics Inc (NASDAQ:NEOS), Almaden Minerals Ltd. (NYSEAMERICAN:AAU), and Ark Restaurants Corp. (NASDAQ:ARKR) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are tons of gauges market participants use to evaluate stocks. A duo of the most under-the-radar gauges are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the top money managers can outperform the broader indices by a solid margin (see the details here).

Samuel Isaly of OrbiMed Advisors

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind we’re going to take a gander at the new hedge fund action regarding Alpine Immune Sciences, Inc. (NASDAQ:ALPN).

What does smart money think about Alpine Immune Sciences, Inc. (NASDAQ:ALPN)?

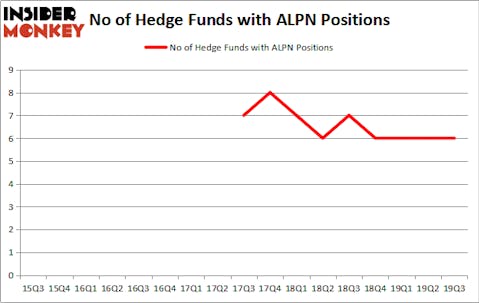

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in ALPN over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, OrbiMed Advisors held the most valuable stake in Alpine Immune Sciences, Inc. (NASDAQ:ALPN), which was worth $14.5 million at the end of the third quarter. On the second spot was Frazier Healthcare Partners which amassed $10.2 million worth of shares. Biotechnology Value Fund, Deerfield Management, and Tiger Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Frazier Healthcare Partners allocated the biggest weight to Alpine Immune Sciences, Inc. (NASDAQ:ALPN), around 3.18% of its 13F portfolio. Biotechnology Value Fund is also relatively very bullish on the stock, setting aside 0.47 percent of its 13F equity portfolio to ALPN.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s go over hedge fund activity in other stocks similar to Alpine Immune Sciences, Inc. (NASDAQ:ALPN). We will take a look at Neos Therapeutics Inc (NASDAQ:NEOS), Almaden Minerals Ltd. (NYSEAMERICAN:AAU), Ark Restaurants Corp. (NASDAQ:ARKR), and Caledonia Mining Corporation Plc (NYSEAMERICAN:CMCL). This group of stocks’ market caps match ALPN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEOS | 10 | 8715 | 0 |

| AAU | 1 | 1335 | -1 |

| ARKR | 1 | 1843 | 0 |

| CMCL | 1 | 98 | 0 |

| Average | 3.25 | 2998 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.25 hedge funds with bullish positions and the average amount invested in these stocks was $3 million. That figure was $32 million in ALPN’s case. Neos Therapeutics Inc (NASDAQ:NEOS) is the most popular stock in this table. On the other hand Almaden Minerals Ltd. (NYSEAMERICAN:AAU) is the least popular one with only 1 bullish hedge fund positions. Alpine Immune Sciences, Inc. (NASDAQ:ALPN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately ALPN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ALPN were disappointed as the stock returned -23.5% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.