Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Agnico Eagle Mines Ltd (USA) (NYSE:AEM).

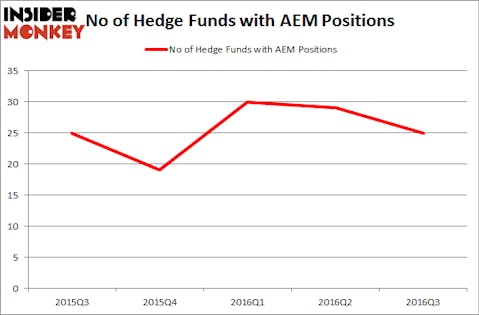

Is Agnico Eagle Mines Ltd (USA) (NYSE:AEM) a buy here? The best stock pickers are taking a bearish view. The number of long hedge fund positions shrunk by 4 lately. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Principal Financial Group Inc (NYSE:PFG), Advance Auto Parts, Inc. (NYSE:AAP), and Twitter Inc (NYSE:TWTR) to gather more data points.

Follow Agnico Eagle Mines Ltd (NYSE:AEM)

Follow Agnico Eagle Mines Ltd (NYSE:AEM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Sashkin/Shutterstock.com

Now, let’s review the recent action regarding Agnico Eagle Mines Ltd (USA) (NYSE:AEM).

Hedge fund activity in Agnico Eagle Mines Ltd (USA) (NYSE:AEM)

Heading into the fourth quarter of 2016, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a plunge of 14% from one quarter earlier. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the most valuable position in Agnico Eagle Mines Ltd (USA) (NYSE:AEM). According to regulatory filings, the fund has a $169.1 million position in the stock, comprising 0.6% of its 13F portfolio. Sitting at the No. 2 spot is Paulson & Co, managed by billionaire John Paulson, which holds a $68.3 million position; 0.7% of its 13F portfolio is allocated to the stock. Some other peers that are bullish include Cliff Asness’s AQR Capital Management, Eric Sprott’s Sprott Asset Management and Stanley Druckenmiller’s Duquesne Capital.

Judging by the fact that Agnico Eagle Mines Ltd (USA) (NYSE:AEM) has faced declining sentiment from the aggregate hedge fund industry, it’s easy to see that there exists a select few hedgies who sold off their entire stakes by the end of the third quarter. At the top of the heap, Jean-Marie Eveillard’s First Eagle Investment Management dropped the biggest position of all the hedgies watched by Insider Monkey, totaling about $750.8 million in call options, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund said goodbye to about $15.9 million worth of options. These bearish behaviors are interesting, as total hedge fund interest dropped by 4 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Agnico Eagle Mines Ltd (USA) (NYSE:AEM) but similarly valued. These stocks are Principal Financial Group Inc (NYSE:PFG), Advance Auto Parts, Inc. (NYSE:AAP), Twitter Inc (NYSE:TWTR), and Pembina Pipeline Corp (NYSE:PBA). This group of stocks’ market values match AEM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PFG | 15 | 119234 | -3 |

| AAP | 62 | 2779651 | 11 |

| TWTR | 47 | 1080032 | 17 |

| PBA | 11 | 46092 | -1 |

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1.01 billion. That figure was $500 million in AEM’s case. Advance Auto Parts, Inc. (NYSE:AAP) is the most popular stock in this table. On the other hand Pembina Pipeline Corp (NYSE:PBA) is the least popular one with only 11 bullish hedge fund positions. Agnico Eagle Mines Ltd (USA) (NYSE:AEM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AAP might be a better candidate to consider a long position.

Suggested Articles:

Best Selling Soft Drinks In The World

Countries That Consume The Most Fish

Most Expensive Musical Instruments

Disclosure: None