It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 18.7% so far in 2019 and outperformed the S&P 500 ETF by 6.6 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards Aerohive Networks Inc (NYSE:HIVE) changed during the first quarter.

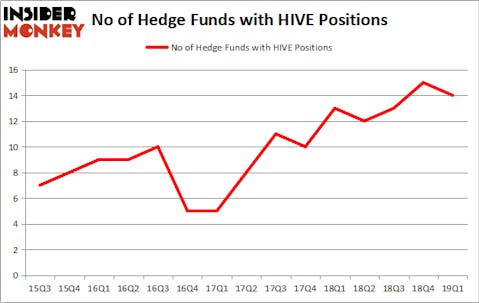

Aerohive Networks Inc (NYSE:HIVE) shareholders have witnessed a decrease in enthusiasm from smart money in recent months. Our calculations also showed that HIVE isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s check out the recent hedge fund action encompassing Aerohive Networks Inc (NYSE:HIVE).

How have hedgies been trading Aerohive Networks Inc (NYSE:HIVE)?

Heading into the second quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the previous quarter. By comparison, 13 hedge funds held shares or bullish call options in HIVE a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in Aerohive Networks Inc (NYSE:HIVE). Renaissance Technologies has a $18.5 million position in the stock, comprising less than 0.1%% of its 13F portfolio. On Renaissance Technologies’s heels is Lynrock Lake, led by Cynthia Paul, holding a $18 million position; 4.7% of its 13F portfolio is allocated to the company. Other members of the smart money that are bullish include Jonathan Guo’s Yiheng Capital, Chuck Royce’s Royce & Associates and D. E. Shaw’s D E Shaw.

Seeing as Aerohive Networks Inc (NYSE:HIVE) has experienced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there is a sect of money managers who were dropping their full holdings heading into Q3. It’s worth mentioning that Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital dumped the largest position of all the hedgies followed by Insider Monkey, valued at about $0.1 million in stock, and Matthew Hulsizer’s PEAK6 Capital Management was right behind this move, as the fund sold off about $0.1 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 1 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Aerohive Networks Inc (NYSE:HIVE) but similarly valued. These stocks are Ames National Corporation (NASDAQ:ATLO), Southern First Bancshares, Inc. (NASDAQ:SFST), MagnaChip Semiconductor Corporation (NYSE:MX), and Uranium Energy Corp. (NYSEAMEX:UEC). This group of stocks’ market valuations are similar to HIVE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATLO | 3 | 19629 | 0 |

| SFST | 7 | 32133 | 1 |

| MX | 18 | 104030 | -2 |

| UEC | 9 | 7730 | 3 |

| Average | 9.25 | 40881 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.25 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $70 million in HIVE’s case. MagnaChip Semiconductor Corporation (NYSE:MX) is the most popular stock in this table. On the other hand Ames National Corporation (NASDAQ:ATLO) is the least popular one with only 3 bullish hedge fund positions. Aerohive Networks Inc (NYSE:HIVE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately HIVE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HIVE were disappointed as the stock returned -27.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.