At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not Acushnet Holdings Corp. (NYSE:GOLF) makes for a good investment right now.

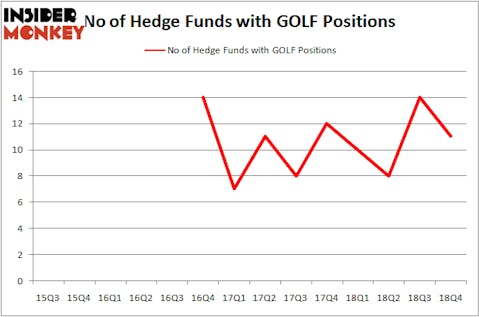

Acushnet Holdings Corp. (NYSE:GOLF) has seen a decrease in hedge fund interest of late. Our calculations also showed that GOLF isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are dozens of formulas market participants can use to appraise publicly traded companies. Two of the less known formulas are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the best investment managers can trounce the broader indices by a solid amount (see the details here).

Let’s take a gander at the fresh hedge fund action surrounding Acushnet Holdings Corp. (NYSE:GOLF).

How have hedgies been trading Acushnet Holdings Corp. (NYSE:GOLF)?

At Q4’s end, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of -21% from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in GOLF a year ago. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Sensato Capital Management, managed by Ernest Chow and Jonathan Howe, holds the largest position in Acushnet Holdings Corp. (NYSE:GOLF). Sensato Capital Management has a $8.8 million position in the stock, comprising 2.3% of its 13F portfolio. Coming in second is Millennium Management, led by Israel Englander, holding a $5.9 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions contain Cliff Asness’s AQR Capital Management, D. E. Shaw’s D E Shaw and Joel Greenblatt’s Gotham Asset Management.

Judging by the fact that Acushnet Holdings Corp. (NYSE:GOLF) has witnessed bearish sentiment from hedge fund managers, it’s easy to see that there were a few hedgies who were dropping their positions entirely last quarter. At the top of the heap, Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital sold off the biggest investment of the “upper crust” of funds watched by Insider Monkey, totaling about $3 million in stock. Jim Simons’s fund, Renaissance Technologies, also sold off its stock, about $2.7 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest fell by 3 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Acushnet Holdings Corp. (NYSE:GOLF). These stocks are Workiva Inc (NYSE:WK), Moelis & Company (NYSE:MC), FCB Financial Holdings Inc (NYSE:FCB), and Amkor Technology, Inc. (NASDAQ:AMKR). This group of stocks’ market valuations resemble GOLF’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WK | 16 | 147554 | 1 |

| MC | 21 | 72307 | 1 |

| FCB | 18 | 269486 | -5 |

| AMKR | 24 | 51025 | 6 |

| Average | 19.75 | 135093 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $135 million. That figure was $21 million in GOLF’s case. Amkor Technology, Inc. (NASDAQ:AMKR) is the most popular stock in this table. On the other hand Workiva Inc (NYSE:WK) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Acushnet Holdings Corp. (NYSE:GOLF) is even less popular than WK. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on GOLF, though not to the same extent, as the stock returned 20% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.