Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. NASDAQ and Russell 2000 indices were already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points in the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Acorda Therapeutics Inc (NASDAQ:ACOR).

Is Acorda Therapeutics Inc (NASDAQ:ACOR) going to take off soon? The smart money is betting on the stock. The number of bullish hedge fund bets moved up by 1 lately. Our calculations also showed that ACOR isn’t among the 30 most popular stocks among hedge funds. ACOR was in 22 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 21 hedge funds in our database with ACOR holdings at the end of the previous quarter.

Today there are a lot of signals investors put to use to assess stocks. A pair of the less utilized signals are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the top money managers can beat the S&P 500 by a healthy amount (see the details here).

We’re going to check out the key hedge fund action surrounding Acorda Therapeutics Inc (NASDAQ:ACOR).

How have hedgies been trading Acorda Therapeutics Inc (NASDAQ:ACOR)?

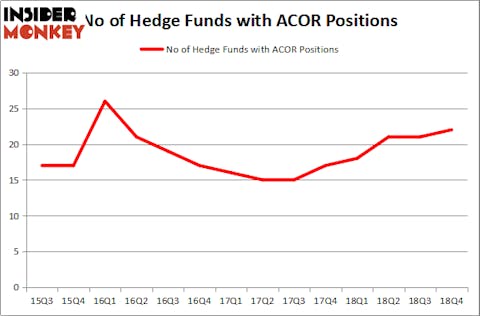

Heading into the first quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ACOR over the last 14 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in Acorda Therapeutics Inc (NASDAQ:ACOR) was held by Scopia Capital, which reported holding $85.6 million worth of stock at the end of December. It was followed by Renaissance Technologies with a $34.1 million position. Other investors bullish on the company included Millennium Management, Marshall Wace LLP, and Balyasny Asset Management.

Now, some big names have been driving this bullishness. Partner Fund Management, managed by Christopher James, assembled the largest call position in Acorda Therapeutics Inc (NASDAQ:ACOR). Partner Fund Management had $27.1 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $6.2 million position during the quarter. The other funds with brand new ACOR positions are Ken Griffin’s Citadel Investment Group, Philippe Jabre’s Jabre Capital Partners, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks similar to Acorda Therapeutics Inc (NASDAQ:ACOR). These stocks are Arlo Technologies, Inc. (NYSE:ARLO), National Energy Services Reunited Corp. (NASDAQ:NESR), Perficient, Inc. (NASDAQ:PRFT), and Goldman Sachs BDC, Inc. (NYSE:GSBD). This group of stocks’ market values resemble ACOR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARLO | 8 | 9670 | -4 |

| NESR | 4 | 25193 | 0 |

| PRFT | 14 | 21710 | -5 |

| GSBD | 4 | 4834 | 0 |

| Average | 7.5 | 15352 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.5 hedge funds with bullish positions and the average amount invested in these stocks was $15 million. That figure was $180 million in ACOR’s case. Perficient, Inc. (NASDAQ:PRFT) is the most popular stock in this table. On the other hand National Energy Services Reunited Corp. (NASDAQ:NESR) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Acorda Therapeutics Inc (NASDAQ:ACOR) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ACOR wasn’t nearly as popular as these 15 stock and hedge funds that were betting on ACOR were disappointed as the stock returned -29.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.