Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Acadia Healthcare Company Inc (NASDAQ:ACHC) and see how the stock is affected by the recent hedge fund activity.

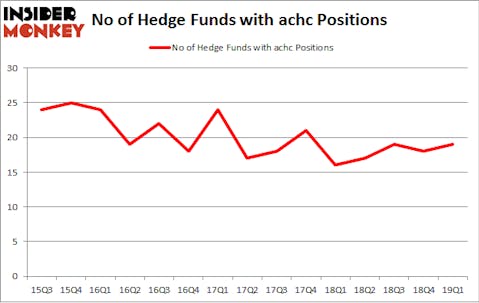

Acadia Healthcare Company Inc (NASDAQ:ACHC) was in 19 hedge funds’ portfolios at the end of March. ACHC investors should be aware of an increase in enthusiasm from smart money of late. There were 18 hedge funds in our database with ACHC positions at the end of the previous quarter. Our calculations also showed that achc isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are many tools stock traders employ to analyze their stock investments. Two of the most underrated tools are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can beat the market by a very impressive amount (see the details here).

Let’s check out the fresh hedge fund action encompassing Acadia Healthcare Company Inc (NASDAQ:ACHC).

How have hedgies been trading Acadia Healthcare Company Inc (NASDAQ:ACHC)?

Heading into the second quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the fourth quarter of 2018. On the other hand, there were a total of 16 hedge funds with a bullish position in ACHC a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Elliott Management, managed by Paul Singer, holds the largest position in Acadia Healthcare Company Inc (NASDAQ:ACHC). Elliott Management has a $127.5 million position in the stock, comprising 0.8% of its 13F portfolio. The second largest stake is held by P2 Capital Partners, managed by Claus Moller, which holds a $125.4 million position; 10.4% of its 13F portfolio is allocated to the stock. Other peers that are bullish consist of William Leland Edwards’s Palo Alto Investors, Didric Cederholm’s Lion Point and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management.

As industrywide interest jumped, key money managers have jumped into Acadia Healthcare Company Inc (NASDAQ:ACHC) headfirst. Palo Alto Investors, managed by William Leland Edwards, created the most valuable position in Acadia Healthcare Company Inc (NASDAQ:ACHC). Palo Alto Investors had $60.4 million invested in the company at the end of the quarter. Joseph Mathias’s Concourse Capital Management also initiated a $3.6 million position during the quarter. The other funds with brand new ACHC positions are Manoj JaináandáSohit Khurana’s Maso Capital, Brandon Haley’s Holocene Advisors, and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Acadia Healthcare Company Inc (NASDAQ:ACHC) but similarly valued. We will take a look at Emergent Biosolutions Inc (NYSE:EBS), Mirati Therapeutics, Inc. (NASDAQ:MRTX), Genomic Health, Inc. (NASDAQ:GHDX), and Quidel Corporation (NASDAQ:QDEL). This group of stocks’ market caps resemble ACHC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EBS | 11 | 185718 | -5 |

| MRTX | 28 | 950980 | 1 |

| GHDX | 25 | 1054605 | 1 |

| QDEL | 18 | 119938 | 2 |

| Average | 20.5 | 577810 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $578 million. That figure was $463 million in ACHC’s case. Mirati Therapeutics, Inc. (NASDAQ:MRTX) is the most popular stock in this table. On the other hand Emergent Biosolutions Inc (NYSE:EBS) is the least popular one with only 11 bullish hedge fund positions. Acadia Healthcare Company Inc (NASDAQ:ACHC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on ACHC as the stock returned 12% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.