Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on several financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of T-Mobile US Inc (NYSE:TMUS) based on that data.

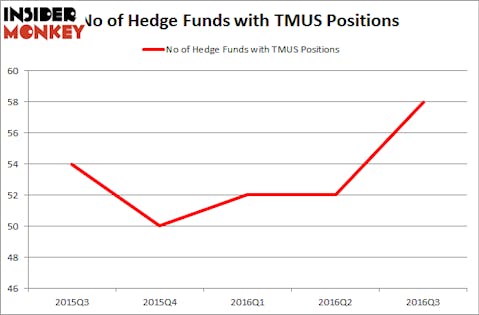

Is T-Mobile US Inc (NYSE:TMUS) a buy, sell, or hold? Money managers are getting more optimistic. The number of long hedge fund bets improved by 6 in recent months. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Mizuho Financial Group Inc. (ADR) (NYSE:MFG), The Kroger Co. (NYSE:KR), and Carnival plc (ADR) (NYSE:CUK) to gather more data points.

Follow T-Mobile Us Inc. (NASDAQ:TMUS)

Follow T-Mobile Us Inc. (NASDAQ:TMUS)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: dcwcreations / 123RF Stock Photo

Hedge fund activity in T-Mobile US Inc (NYSE:TMUS)

At the end of the third quarter, a total of 58 of the hedge funds tracked by Insider Monkey were long this stock, a rise of 12% from the second quarter of 2016. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Viking Global, managed by Andreas Halvorsen, holds the biggest position in T-Mobile US Inc (NYSE:TMUS). Viking Global has a $642.7 million position in the stock, comprising 2.8% of its 13F portfolio. The second largest stake is held by Soroban Capital Partners, managed by Eric W. Mandelblatt, which holds a $420.5 million call position. Other hedge funds and institutional investors that hold long positions comprise Paul Marshall and Ian Wace’s Marshall Wace LLP and Ken Griffin’s Citadel Investment Group.

Now, key hedge funds were leading the bulls’ herd. Maverick Capital, managed by Lee Ainslie, created the largest position in T-Mobile US Inc (NYSE:TMUS). Maverick Capital had $44.5 million invested in the company at the end of the quarter. Keith Meister’s Corvex Capital also initiated a $40.4 million position during the quarter. The following funds were also among the new TMUS investors: Leon Shaulov’s Maplelane Capital, Ben Gambill’s Tiger Eye Capital, and Alok Agrawal’s Bloom Tree Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as T-Mobile US Inc (NYSE:TMUS) but similarly valued. These stocks are Mizuho Financial Group Inc. (ADR) (NYSE:MFG), The Kroger Co. (NYSE:KR), Carnival plc (ADR) (NYSE:CUK), and Travelers Companies Inc (NYSE:TRV). All of these stocks’ market caps are closest to TMUS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MFG | 5 | 11054 | 0 |

| KR | 40 | 946147 | 5 |

| CUK | 10 | 41201 | -1 |

| TRV | 30 | 542088 | 1 |

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $385 million. That figure was $3.34 billion in TMUS’s case. The Kroger Co. (NYSE:KR) is the most popular stock in this table. On the other hand Mizuho Financial Group Inc. (ADR) (NYSE:MFG) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks T-Mobile US Inc (NYSE:TMUS) is more popular among hedge funds. Considering that hedge funds are very fond of this stock in relation to its market cap peers and growing fonder, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None