Intuitive Surgical, Inc. (NASDAQ:ISRG) Q2 2023 Earnings Call Transcript July 20, 2023

Intuitive Surgical, Inc. misses on earnings expectations. Reported EPS is $0.85 EPS, expectations were $1.33.

Operator: Ladies and gentlemen, thank you for standing by and welcome to the Intuitive Q2 2023 Earnings Release. At this time all participants are in a listen-only mode. Later, we will conduct a question-and-answer session. [Operator Instructions] As a reminder, today’s call is being recorded. I will now turn the call over to your host, Head of Investor Relations, Brian King. Please go ahead, sir.

Brian King: Thank you. Good afternoon and welcome to Intuitive’s second quarter earnings conference call. With me today, we have Gary Guthart, our CEO and Jamie Samath, our CFO. Before we begin, I would like to inform you that comments mentioned on today’s call may be deemed to contain forward-looking statements. Actual results may differ materially from those expressed or implied as a result of certain risks and uncertainties. These risks and uncertainties are described in detail our Securities and Exchange Commission filings, including our most recent Form 10-K filed on February 10, 2023, and Form 10-Q filed on April 20, 2023. Our SEC filings can be found through our website or at the SEC’s website. Investors are cautioned not to place undue reliance on such forward-looking statements.

Please note that this conference call will be available for audio replay on our website at intuitive.com on the Events section under our Investor Relations page. Today’s press release and supplementary financial data tables have been posted to our website. Today’s format will consist of providing you with highlights of our second quarter results, as described in our press release announced earlier today, followed by a question-and-answer session. Gary will present quarter’s business and operational highlights, Jamie will provide a review of our financial results, then I will discuss procedure and clinical highlights and provide our updated financial outlook for 2023. And finally, we will host a question-and-answer session. And with that, I will turn it over to Gary.

Gary Guthart: Thank you for joining us today. The fundamentals of our business were healthy in the second quarter with strong procedure and utilization growth and strong capital placements. Our product operations teams continued to build capacity and deliver in a dynamic supply chain environment as customers increasingly rely upon us for routine use. Our research and development efforts continued to build momentum in the quarter, including positive development milestones for our Intuitive ecosystem including systems, instruments, accessories, digital tools and new indications. Turning first to procedures, growth in the quarter was 22%. Areas of strength included general surgery and gynecology for benign conditions, particularly in the United States.

General surgery procedure growth was led by cholecystectomy and hernia repair. Colon and rectal procedure growth was healthy. Global procedure growth was also strong in the quarter led by a recovery in China and continued strength in Japan, Germany and the UK. Ion procedures showed continued strength with 145% growth in Q2 of ’23. SP procedure growth was accretive with 40% global growth in the quarter driven by accelerating growth in the United States. On the capital front, we placed 331 systems in Q2 compared with 279 systems in Q2 of last year. Our clinical installed base now stands at 7,900 multi-port da Vinci systems, 435 Ion systems, and 142 single-port da Vinci systems. Overall, our capital placement trends reflected demand for additional capacity in multi-port, strong interest in our Ion system and stable demand for SP as we build our SP indications.

System utilization, defined as procedures per installed clinical system per quarter, grew 9% globally year-over-year, reaching a new high as customers adopt a broad mix of procedures on our systems. We believe real world evidence of improvements across the Quadruple Aim from better patient outcomes to surgeon satisfaction and lower total cost to treat per patient episode underpin this increasing utilization. Turning to our finances. Our revenue grew 15% in the quarter. Our capital and operating expenses were within our spend guidance, reflecting continued investments in R&D to support growth of our platforms and digital tools, expansion of our manufacturing and commercial footprints, and capital amortization. We will continue investing in R&D, manufacturing and commercial operations to serve our global markets at industrial scale.

These investments are likely to be lumpy over the next couple of years as significant operations expansions and other projects complete. Taking a step back, we’ve found that the Quadruple Aim is the right North Star for us, focusing on demonstrable improvements to outcomes across specific procedures and patient populations, increasing patient and care team satisfaction and lowering the total cost to treat per patient episode. As electronic medical records have been adopted, we have partnered with our customers to analyze this data. Building real world evidence in big data approaches measure Quadruple Aim improvements within countries, regions and health systems. Compared with our ecosystem investments in training, services and products, and powered by digital tools that can generate actionable intelligence from surgical data, we can help our customers analyze their programs, recommend and support to improve performance and lower total costs.

This integrated business system is catalyzing our customers’ goal of strong MIS programs by surfacing actionable and measurable steps. Our approach is scalable for us too, working for our da Vinci platforms and for Ion and opening the door to future opportunities. Turning to our ecosystem investments. We’re making solid progress extending our offerings to new clinical domains and new regions. For da Vinci multiport, we recently obtained NMPA registration for Xi local production in China. This means our da Vinci Xi will be able to compete for the locally sourced tender subset of the recently released updated national quota. Our da Vinci SP team achieved several milestones recently. We completed patient enrollment for our colorectal and our thoracic IDE trials, continued our first phase of launch of SP in Japan and submitted our CE Mark dossier for SP in Europe.

Turning to Ion, our team installed their first Ion system in the UK and initiated first cases. For our digital tools, we have initiated our Phase 1 launch of Case Insights, our name for our computational observer. Case Insights is a tool that works with the da Vinci system and hospital data to build AI models that find correlations between surgical technique, patient populations and surgical outcomes. Our first phase of launch builds on work over the past few years with our clinical research partners to refine objective performance indicators and link them to actionable changes to improve outcomes, shorten training times and improve surgical program efficiency. We think these computational tools can make a significant impact using real world and real time data to improve skills and outcomes and to inform future product and automation opportunities.

That said, features can be built quickly, but long-term validation is arduous. With our science driven organization and we’ll work through validation pathways in pursuit of long-term success. We do not expect material revenue from Case Insights for the next several quarters. In closing, our core business has momentum, we see a significant long-term opportunity to improve the Quadruple Aim using our integrated ecosystem powered by analytics and we are pacing our investments to catalyze that opportunity. I’ll now turn the time over to Jamie, who will take you through our finances in greater detail.

Jamie Samath: Good afternoon. I will describe the highlights of our performance on a non-GAAP or pro form a basis. I will also summarize our GAAP performance later in my prepared remarks. A reconciliation between our pro forma and GAAP results is posted on our website. Global procedure growth in Q2 of 22% reflected US procedure growth of 19% and 28% procedure growth outside of the US. Procedures in Q2 benefitted from higher patient admissions as hospitals particularly in the US catch-up with patients whose diagnosis and/or treatment was delayed during the pandemic. Consistent with our comments last quarter, contributions to procedure growth from surgeons new to the da Vinci platform were strong, reflecting both the strength of our training capabilities and an increasing number of graduates of residency and fellowship programs who are trained on da Vinci.

Within one of our target procedure areas, bariatric surgery, our growth rate in the US slowed during the quarter. Some customers have indicated that they are seeing increased patient interest in weight loss drugs. It is too early to conclude if the slowing growth is a temporary pause as patients evaluate these new drug therapies or if it is a trend that continues. We believe that during the quarter, da Vinci continued to gain market share in the bariatric surgical market. Our US procedure growth of 28% reflected strength in China, the UK, Germany and Japan. Strong procedure growth in China was driven by a continued recovery from more recent COVID related impacts and a favorable comparison to Q2 last year, which was also impacted by the pandemic.

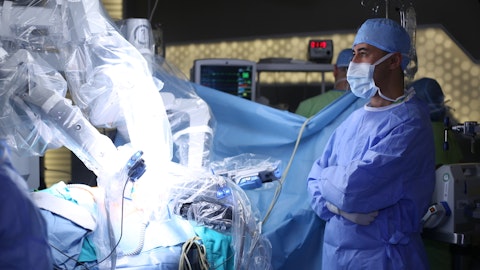

Master Video/Shutterstock.com

Consistent with our comments last quarter, growth in non-urology procedures outside of the United States was accretive, growing at approximately 35%, driven by increases in colorectal, hysterectomy and thoracic procedures. Turning to other key metrics. In Q2, the installed base of da Vinci systems grew 13% to just over 8,000 systems, driven primarily by demand for additional capacity given procedure growth. Average system utilization grew almost 9% year-over-year reflecting an increasing mix of shorter duration benign procedures in the US and customers prioritizing use of their existing assets given the financial pressures they face. With respect to capital performance, we placed 331 systems in the second quarter, ahead of our expectations.

Capital strength in the quarter included a higher number of placements to our distributors and a higher number of multi-system deals in the US relative to recent trends, reflecting in part certain placements accelerated into Q2 from future quarters. Despite Q2 system placements being ahead of our expectations, customers particularly in the US appear to be cautious in their capital spending given ongoing financial pressures. We placed 279 systems in Q2 of last year, which as a reminder, reflected a delay in the shipment of approximately 15 systems from June into July as a result of supply chain challenges we encountered during the quarter. Q2 revenue was $1.8 billion, an increase of 15% year-over-year. On a constant currency basis, second quarter revenue grew approximately 17%.

Recurring revenue represented 85% of total revenue as compared 72% for the full year 2019 and grew 20% over last year, driven by procedure growth and an increase in the installed base of systems under operating lease arrangements. Additional revenue statistics and trends are as follows. In the US, we placed 157 systems in the second quarter compared to 150 systems placed last year. Outside the US, we placed 174 systems in Q2 compared with 129 systems last year. Current quarter system placements included 76 into Europe, 33 into Japan and 16 into China, compared with 78 into Europe, 18 into Japan and 15 into China in Q2 of last year. During the quarter, the China National Health Commission published the fourteenth five-year quota of 559 robotic systems.

For those systems awarded to our JV under the new quota, we expect a significant majority to be placed in 2024 through 2027. We are seeing increasing participation of local competitors in tender processes under the national quota. In addition, during 2023, we have experienced pricing pressure in China as a result of provincial government policy changes and competition. The dynamics create greater variability in the outlook for our procedure, system placement and revenue performance in China. In Q2, 60 of the 331 systems placed were trading transactions compared to 56 trading transactions in the second quarter of last year. As of the end of Q2, there are approximately 500 SIs remaining in the installed base, of which 97 are in the US. Leasing represented 50% of Q2 placements compared with 42% for both last quarter and last year.

In the US, 78% of system placements in Q2 were under operating lease arrangements compared to 59% last quarter. The higher rate of operating leases in the US is primarily driven by an increasing customer preference for our usage-based leasing models in part due to capital budget constraints and continuing financial pressures faced by many of our customers. In addition, some customers are choosing leasing structures to preserve flexibility to upgrade to next generation technology. As a result of these dynamics and the earlier stage of our leasing program with OUS customers, we continue to expect that the proportion of placements under operating leases will increase over time. Q2 system average selling prices were $1.39 million as compared to $1.47 million last quarter.

The sequential decrease in system ASPs was primarily driven by a higher mix of ex-placements for purchase deals and geographical mix. We recognized $12 million of lease buyout revenue in the second quarter compared with $24 million last quarter and $23 million in Q2 of 2022. da Vinci instrument and accessory revenue per procedure was approximately $1,840 compared with approximately $1,780 last quarter and $1,900 last year. On a sequential basis, higher I&A per procedure was driven primarily by the I&A price increase we described last quarter and customer ordering patterns. Turning to our Ion platform. In Q2, we placed 59 Ion systems as compared to 41 in Q2 of 2022. Second quarter Ion procedures of approximately 12,700, increased 145% as compared to last year.

During the quarter, we placed our first Ion system in the UK market. And in this early phase of our European launch, we are focused on the collection of clinical data in support of our reimbursement strategy. 12 of the systems placed in the second quarter were SP systems compared to 10 systems last quarter. SP procedures grew by 40% and average system utilization growth accelerated from last quarter’s 12%, increasing by 14% compared to Q2 of last year. Moving on to the rest of the P&L. Pro forma gross margin for the second quarter was 68.5% compared with 67.2% last quarter and 69.2% last year. Pro forma gross margin was lower than last year primarily due to a higher mix of Ion revenue, which currently carries significantly lower margins as compared to the da Vinci business, and lower system ASP.

As we described last quarter, improving product costs and manufacturing efficiency is a priority for our teams over the medium term. Second quarter pro forma operating expenses increased 12% year-over-year driven primarily by increased headcount added throughout last year, higher variable compensation, increased prototype expenses and increased expenses associated with customer training in support of procedure growth. Pro forma operating expenses represented 33% of revenue in Q2 compared to 35% of revenue for the full year 2022, reflecting in part, planned leverage in our enabling functions. Capital expenditures in Q2 were $178 million, primarily comprised of infrastructure investments to expand our facilities footprint and increase manufacturing capacity.

Our pro forma effective tax rate for the second quarter was 22.3%, consistent with our expectations. Second quarter pro forma net income was $507 million or $1.42 per share compared with $415 million or $1.14 per share for Q2 of last year. I will now summarize our GAAP results. GAAP net income was $421 million or $1.18 per share for the second quarter of 2023 compared with GAAP net income of $308 million or $0.85 per share for the second quarter of 2022. The adjustments between pro forma and GAAP net income are outlined and quantified on our website and include excess tax benefits associated with employee stock awards, employee stock-based compensation, amortization of intangibles and gains and losses on strategic investments. We ended the quarter with cash and investments of $7.1 billion compared with $6.6 billion last quarter.

The sequential increase in cash and investments reflected cash from operating activities, proceeds from employee stock exercises, partially offset by capital expenditures. And with that, I would like to turn it over to Brian who will discuss clinical highlights and provide our updated outlook for 2023.

Brian King: Thank you, Jamie. Our overall second quarter procedure growth was 22% year-over-year compared to 14% for the second quarter of 2022 and 26% last quarter. In the US, second quarter 2023 procedure growth was 19% year-over-year compared to 11% for the second quarter of 2022 and 26% last quarter. Q2 growth continued to be driven by strong growth in procedures within general surgery with particular strength in cholecystectomy and hernia repair. Bariatrics growth was healthy in the quarter, but as noted earlier, growth was lower than in prior periods. Outside of the US, second quarter procedure volume grew 28%, compared with 22% for the second quarter of 2022 and 28% last quarter. Second quarter 2023 OUS procedure growth was driven by continued growth in general surgery, primarily from strong growth in colorectal procedures, followed by growth in thoracic procedures.

Growth in urology continued to be healthy, led by kidney procedures, along with continued double-digit growth in prostatectomy. In Europe, we experienced strong growth in the UK, Germany and Spain. In all the regions noted, procedure growth was driven by colorectal and hysterectomy procedures. In Asia, growth was led by China, where we saw a continuing recovery in procedures that were impacted by COVID and benefiting from a favorable comparison to procedure volume that was impacted in the same quarter a year ago. Procedure growth was led by strong growth in urology, namely prostatectomy and kidney procedures. In Japan, growth was led by general surgery with the largest procedure contributions coming from colorectal and gastrectomy procedures.

While still at earlier stages of adoption, India and Taiwan both demonstrated strong growth in gynecology and general surgery procedures. Now turning to the clinical side of our business. Each quarter on these calls, we highlight certain recently published studies that we deem to be notable. However, to gain a more complete understanding of the body of evidence, we encourage all stakeholders to thoroughly review the extensive detail of scientific studies that have been published over the years. This past May, Dr. Zheng from the second affiliated hospital of Jiaxing University in China, published a systematic review and meta-analysis comparing outcomes of robotic right colectomy procedures with outcomes associated with laparoscopic right colectomy.

Published in techniques in coloproctology, this meta-analysis evaluated a total of 15,241 patients across 42 studies with over 2,700 subjects in the robotic right colectomy group and over 12,000 subjects in the laparoscopic group, and included outcomes associated with the entire population as well as outcomes for both intra-corporeal and extracorporeal anastomosis. Looking at the population overall, the authors reported among other outcomes, an approximately half day shorter length of hospital stay, 51% lower risk of conversion to laparotomy, and a 12% lower risk of complications with the robotic approach. Notably, in the subgroup specifically comparing outcomes for procedures with an intra-corporeal anastomosis, the robotic right colectomy group was associated with a shorter length of hospital stay by approximately 16 hours and a 65 % lower risk of conversion to laparotomy.

Within the extracorporeal and anastomosis subgroup, the robotic-assisted approach was associated with a 40% lower risk of overall complications. The authors concluded in part that, quote, the safety and efficacy of robotic right colectomy is superior to laparoscopic right colectomy, especially when an intracorporeal anastomosis has performed, end quote. Turning to a clinical study reporting outcomes for robotic assisted and video assisted thoracoscopic surgery, Dr. Mirza Zain Baig from Danbury Hospital in Connecticut, published outcomes comparing lobectomies performed with either approach using the National Cancer Database. This study focused on patients with complex etiology such as non-small cell lung cancer who had received neoadjuvant therapy, had N1/N2 disease or had a tumor greater than five centimeters and compared 9,506 with over 2,100 in the robotic arm and over 7,000 in the VATS arm.

Notably, when analyzing rates of conversions to open, the authors reported a 7.7% lower rate of conversion to open in the robotic arm with an approximately two times higher risk of conversion associated with the VATS group. The authors concluded, quote, in summary, our analysis of the National Cancer Database suggests that robotic lobectomy for complex lung resections achieve similar perioperative outcomes and R0 resections as VATS lobectomy with the reception of a lower rate of conversion to thoracotomy, end quote. I will now turn to our financial outlook for 2023. Starting with procedures. On our last call, we forecasted full year 2023 procedure growth within a range of 18% to 21%. We are now increasing our forecast and expect full year 2023 procedure growth of 20% to 22%.

The low end of the range reflects uncertainty around the duration of elevated procedure volumes with patients returning to healthcare, continued slowing of bariatric growth rates in the US and macroeconomic challenges that could impact hospitals and patient spending. At the high end of the range, we assume macroeconomic challenges do not have a significant impact on hospital procedure volumes and bariatric growth rates in the US continue at the rate we saw in Q2. The range does not reflect significant material supply chain disruptions or hospital capacity constraints. Turning to gross profit. We continue to expect our 2023 full year pro forma gross profit margin to be within 68% and 69%. Our actual gross profit margin will vary quarter-to-quarter depending largely on product, regional and trading mix and the impact of new product introductions.

With respect to operating expenses, on our last call, we forecast pro forma operating expense growth to be between 11% and 15%. We are adjusting our estimate and now expect our full year pro forma operating expense growth to be between 12% and 15%. We are also updating our estimate for non-cash stock compensation expense to range between $600 million to $620 million in 2023, narrowing the range from our previous estimate of $600 million to $630 million. We are increasing our estimate for other income which is comprised mostly of interest income to total between $160 million and $180 million in 2023, an increase from our previous estimate of $140 million and $160 million. The increase primarily reflects the rise in interest rates. With regard to capital expenditures, we continue to estimate a range of $800 million to $1 billion, primarily for planned facility construction activities.

With regard to income tax, we continue to estimate our 2023 pro forma tax rate to be between 22% and 24% of pre-tax income. That concludes our prepared comments. We will now open the call to your questions.

See also 30 Cities with the Highest Altitudes in the World and 20 Most Efficient Countries in the World.

Q&A Session

Follow Intuitive Surgical Inc (NASDAQ:ISRG)

Follow Intuitive Surgical Inc (NASDAQ:ISRG)

Receive real-time insider trading and news alerts

Operator: Thank you. [Operator Instructions] We’ll go to the first question from the line of Larry Biegelsen, Wells Fargo. Please go ahead.

Larry Biegelsen: Good afternoon. Thanks for taking the question. Hey, Gary, just two for me. One, big picture question on AI, and second, on procedure growth. So AI is obviously having its moment in the sun here, Gary. I’m curious where is Intuitive spending time in applying AI? Is it imaging, movement of the robot, training? I’d love to hear your thoughts and then I have one follow-up.

Gary Guthart: Yeah. Well, let’s start on AI. Let’s talk about what it is. For us, it’s a suite of digital tools that rests on a baseline and then can be built upon using various machine learning techniques, including Computer Vision. We’ve been at it for some time. We started the Internet of Things for surgical robots over a decade ago. We built the baseline of cybersecure privacy compliant pipes that allow us to get access to the data. So there’s some foundational work that was important. That’s kind of step one. Step two is to collaborate with customers and aggregate data that is meaningful. AI is only as good as the quality of the data that you feed it. And so for us, that has been robot data, some other data and electronic medical record data in partnership with our customer base.

We’ve been doing that for several years now. From that, I think you can start to do analytic inspections. You can do analyses on the data, look for correlation. Sometimes it’s pretty simple math that gets you big data explorations, some simple things that we can do to help our customers become more efficient and to expose variation. Over time, you can invest further in things like Computer Vision, which we have been doing and into predictive analytics, the idea that you can look at surgical data science, understand the variation of patient populations and what’s happening in surgery and start to create tools — digital tools that can help improve outcomes or speed learning curves or lower operating costs. And we’re going to work on all of those things.

So, of the things you mentioned, we have our toe in the water in many and we’ve had for some time. As I said in the script, the feature content can be moved pretty quickly. I think the validations take real time to do well, particularly outcome based or interventional validations. And so we’re going to go through and do that with real rigor. So expect us to continue down that pathway.

Larry Biegelsen: That’s very helpful. And then on procedures, I’m just wondering, you talked about some catch-up in Q2. How are you thinking about how much of the backlog of deferred procedures is still left? You talked about the diagnostic procedures on the last call. And any color on what you’re assuming for bariatrics here for the rest of the year? And does that mean international will continue to be stronger than the US? Thanks for taking the questions.

Gary Guthart: Let me talk a little bit about I think the patient population that — that moved to the sidelines during the pandemic and then I’ll turn the assessment over to Jamie. One the — on the kind of the pandemic response, it’s hard to exactly estimate how many folks would have been in diagnostic pipelines that did not get their tests. We do look at the data that’s available to do that. I don’t think it will clear in just one quarter. I think our past experience on these things is that lower utilization happened over a several year period and it will probably take many quarters for it to fully recover. How long that is, I think it’s very, very hard to estimate. So far, so good. You asked a question about bariatrics. I’m going to turn that over to Jamie. He spoke about it a little bit in his prepared remarks.