The product

There is no doubt that Intuitive Surgical, Inc. (NASDAQ:ISRG) makes very futuristic surgical gear in the Da Vinci robot. The advantages of the robot are compelling. The Da Vinci robot allows the surgeon to enter the body less invasively, see anatomy more clearly, and interact with tissue more precisely. The surgical platform costs anywhere from $1 million to $2 million with instruments and accessories costing between $1300 and $2200 per procedure.

Intuitive Surgical, Inc. (NASDAQ:ISRG) has sold about 2700 Da Vinci robots around the world, with about 2000 in the US. They collectively do almost half a million surgical operations per year in disparate fields such as urology, gynecology, cardiac, thoracic, and head and neck. The company itself estimates that the total target procedure market numbers 1.3 million in the US and another 1.3 million in international markets.

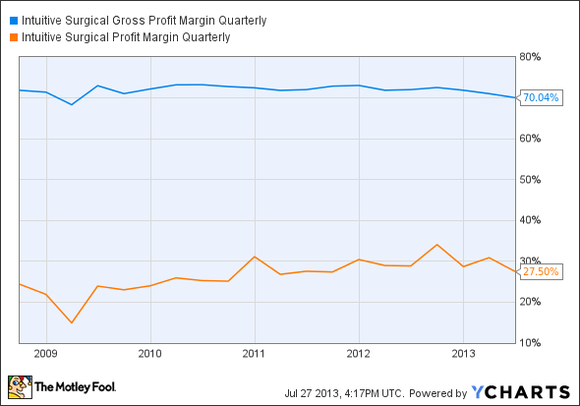

This type of demand and premium pricing has spurred huge growth and great margins. Intuitive Surgical, Inc. (NASDAQ:ISRG) has grown earnings an average of 34% per year over the past five years, and maintained healthy gross margins of over 70% and profit margins of 30%.

But all of this changed when the company warned, on July 9, that it saw headwinds. The company warned that the growth would slow, sending shares down 15% to an 18-month low. Then when second quarter results came out, the company’s stock fell another 7%.

The second quarter results showed slowing growth and margin pressure. The company sold 143 da Vinci robots versus 150 last year, and revenue only climbed 7.8%. Gross margin dropped to 70% from 72%. Profit was $159.1 million, or $3.90 per share, versus $154.9 million, or $3.75 per share, a year earlier. Analysts were expecting $4.04 a share.

In the quarterly presentation, management said

The decline in U.S. system sales was impacted by several factors, including, among other things, increased economic pressure on hospitals, which in turn caused some to defer da Vinci System purchases, and moderating growth in our benign gynecologic procedures…

Analysts are not as excited about the opportunity as before. Northland Capital has a price target of $370 while Cantor Fitzgerald has a price target of $425.

Versus peers

While Intuitive Surgical, Inc. (NASDAQ:ISRG) has no direct competitors, these two companies are also trying to capture the robotic trend.

MAKO Surgical Corp. (NASDAQ:MAKO) is a medical device company that markets its advanced robotic arm solution, RIO system, for the knee and hip. Like da Vinci, the RIO system is less invasive and more accurate than traditional surgical procedures.