Hedge funds are not perfect. They have their bad picks just like everyone else. Valeant, a stock hedge funds have loved, lost 79% during the last 12 months ending in November 21. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 mid-cap stocks among the best performing hedge funds yielded an average return of 18% in the same time period, vs. a gain of 7.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of HP Inc. (NYSE:HPQ).

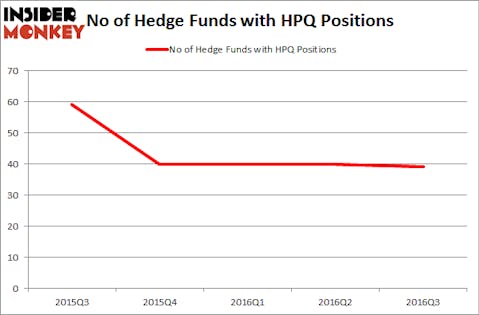

HP Inc. (NYSE:HPQ) was in 39 hedge funds’ portfolios at the end of the third quarter of 2016. HPQ has experienced a decrease in hedge fund sentiment in recent months. There were 40 hedge funds in our database with HPQ positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Paychex, Inc. (NASDAQ:PAYX), State Street Corporation (NYSE:STT), and Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) to gather more data points.

Follow Hp Inc (NYSE:HPQ)

Follow Hp Inc (NYSE:HPQ)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Ken Wolter / Shutterstock.com

Now, we’re going to take a glance at the key action regarding HP Inc. (NYSE:HPQ).

What does the smart money think about HP Inc. (NYSE:HPQ)?

At Q3’s end, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 3% dip from the second quarter of 2016. Hedge fund ownership has remained virtually unchanged over the past 3 quarters, after a huge decline in the fourth quarter of 2015. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the most valuable position in HP Inc. (NYSE:HPQ). AQR Capital Management has a $467.5 million position in the stock. Sitting at the No. 2 spot is Pzena Investment Management, led by Richard S. Pzena, holding a $268.9 million position; the fund has 1.6% of its 13F portfolio invested in the stock. Some other peers that hold long positions encompass John Overdeck and David Siegel’s Two Sigma Advisors, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and David Harding’s Winton Capital Management.

Since HP Inc. (NYSE:HPQ) has experienced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of hedge funds that decided to sell off their entire stakes in the third quarter. Intriguingly, Joel Greenblatt’s Gotham Asset Management dropped the biggest stake of the 700 funds followed by Insider Monkey, valued at close to $32.2 million in stock. Charles de Vaulx’s fund, International Value Advisers, also sold off its stock, about $13.4 million worth. These moves are interesting, as total hedge fund interest dropped by 1 fund in the third quarter.

Let’s go over hedge fund activity in other stocks similar to HP Inc. (NYSE:HPQ). These stocks are Paychex, Inc. (NASDAQ:PAYX), State Street Corporation (NYSE:STT), Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), and Edwards Lifesciences Corp (NYSE:EW). This group of stocks’ market caps resemble HPQ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAYX | 24 | 612841 | 1 |

| STT | 31 | 633743 | -2 |

| VRTX | 33 | 454491 | 0 |

| EW | 38 | 2001027 | -5 |

As you can see these stocks had an average of 31.5 hedge funds with bullish positions and the average amount invested in these stocks was $926 million. That figure was $1.29 billion in HPQ’s case. Edwards Lifesciences Corp (NYSE:EW) is the most popular stock in this table. On the other hand Paychex, Inc. (NASDAQ:PAYX) is the least popular one with only 24 bullish hedge fund positions. Compared to these stocks HP Inc. (NYSE:HPQ) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers and seem to consider it a solid long-term investment, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None