At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Is Digimarc Corp (NASDAQ:DMRC) a safe investment today? The smart money is betting on the stock. The number of bullish hedge fund bets that are revealed through 13F filings grew by 1 lately. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Protagonist Therapeutics Inc (NASDAQ:PTGX), Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL), and MidWestOne Financial Group, Inc. (NASDAQ:MOFG) to gather more data points.

Follow Digimarc Corp (NASDAQ:DMRC)

Follow Digimarc Corp (NASDAQ:DMRC)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Sergey Nivens/shutterstock.com

How have hedgies been trading Digimarc Corp (NASDAQ:DMRC)?

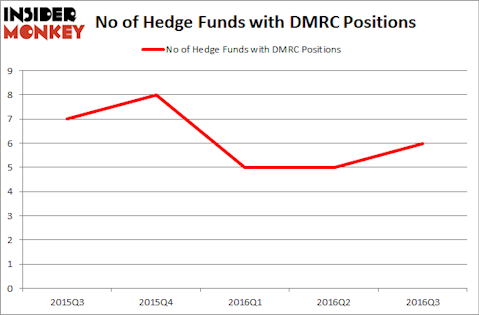

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a 20% uptick from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards DMRC over the last 5 quarters, which slumped heavily in Q1 but has otherwise remained stable. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Richard Mashaal’s RIMA Senvest Management has the biggest position in Digimarc Corp (NASDAQ:DMRC), worth close to $32.6 million, accounting for 2.3% of its total 13F portfolio. On RIMA Senvest Management’s heels is George Soros’ Soros Fund Management, with a $2.6 million position. Other peers with similar optimism consist of Bruce Salomon’s Elberon Capital, Amy Minella’s Cardinal Capital, and Bryant Regan’s Lafitte Capital Management. We should note that Soros Fund Management is among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.