Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before last year’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Wells Fargo & Company (NYSE:WFC) changed recently.

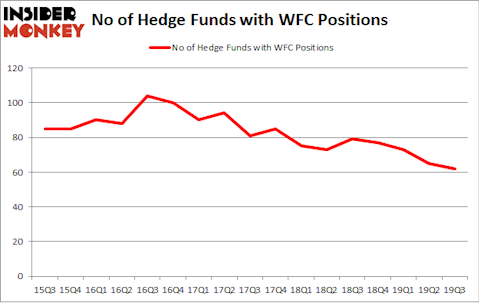

Wells Fargo & Company (NYSE:WFC) was in 62 hedge funds’ portfolios at the end of September. WFC has experienced a decrease in support from the world’s most elite money managers in recent months. There were 65 hedge funds in our database with WFC holdings at the end of the previous quarter. Our calculations also showed that WFC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In today’s marketplace there are a lot of signals stock market investors can use to analyze stocks. A couple of the most under-the-radar signals are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the elite fund managers can outpace their index-focused peers by a very impressive amount (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example one of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now we’re going to take a peek at the fresh hedge fund action surrounding Wells Fargo & Company (NYSE:WFC).

Hedge fund activity in Wells Fargo & Company (NYSE:WFC)

At Q3’s end, a total of 62 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the second quarter of 2019. On the other hand, there were a total of 79 hedge funds with a bullish position in WFC a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Berkshire Hathaway held the most valuable stake in Wells Fargo & Company (NYSE:WFC), which was worth $19084.9 million at the end of the third quarter. On the second spot was Eagle Capital Management which amassed $1421.5 million worth of shares. Gardner Russo & Gardner, Theleme Partners, and Pzena Investment Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Magnolia Capital Fund allocated the biggest weight to Wells Fargo & Company (NYSE:WFC), around 37.88% of its 13F portfolio. Theleme Partners is also relatively very bullish on the stock, earmarking 24.1 percent of its 13F equity portfolio to WFC.

Due to the fact that Wells Fargo & Company (NYSE:WFC) has experienced declining sentiment from the smart money, logic holds that there is a sect of money managers that elected to cut their positions entirely by the end of the third quarter. Interestingly, Anthony Bozza’s Lakewood Capital Management dropped the biggest position of the “upper crust” of funds followed by Insider Monkey, valued at close to $50.8 million in stock. Michael Kharitonov and Jon David McAuliffe’s fund, Voleon Capital, also cut its stock, about $40.2 million worth. These transactions are interesting, as total hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Wells Fargo & Company (NYSE:WFC) but similarly valued. These stocks are Merck & Co., Inc. (NYSE:MRK), The Boeing Company (NYSE:BA), Cisco Systems, Inc. (NASDAQ:CSCO), and UnitedHealth Group Inc. (NYSE:UNH). This group of stocks’ market values resemble WFC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MRK | 73 | 4568239 | 3 |

| BA | 78 | 3964531 | 4 |

| CSCO | 58 | 4154237 | 3 |

| UNH | 77 | 5610847 | 9 |

| Average | 71.5 | 4574464 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 71.5 hedge funds with bullish positions and the average amount invested in these stocks was $4574 million. That figure was $25231 million in WFC’s case. The Boeing Company (NYSE:BA) is the most popular stock in this table. On the other hand Cisco Systems, Inc. (NASDAQ:CSCO) is the least popular one with only 58 bullish hedge fund positions. Wells Fargo & Company (NYSE:WFC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately WFC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); WFC investors were disappointed as the stock returned 21.5% in 2019 (as of 12/23) and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks already outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.