While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the third quarter and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Science Applications International Corp (NYSE:SAIC) and see how the stock performed in comparison to hedge funds’ consensus picks.

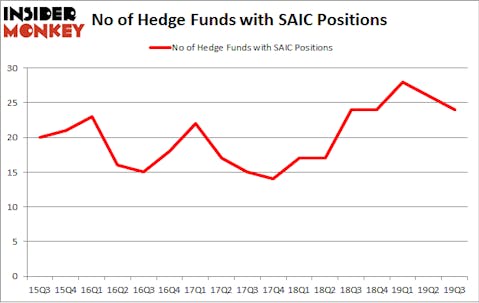

Is Science Applications International Corp (NYSE:SAIC) undervalued? The best stock pickers are reducing their bets on the stock. The number of long hedge fund positions dropped by 2 in recent months. Our calculations also showed that SAIC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

If you’d ask most traders, hedge funds are seen as underperforming, old investment tools of yesteryear. While there are over 8000 funds in operation today, Our researchers look at the top tier of this club, about 750 funds. Most estimates calculate that this group of people have their hands on the majority of the smart money’s total asset base, and by tracking their top investments, Insider Monkey has unsheathed various investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Phill Gross of Adage Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now we’re going to take a peek at the recent hedge fund action encompassing Science Applications International Corp (NYSE:SAIC).

What does smart money think about Science Applications International Corp (NYSE:SAIC)?

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from the second quarter of 2019. By comparison, 24 hedge funds held shares or bullish call options in SAIC a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Israel Englander’s Millennium Management has the largest position in Science Applications International Corp (NYSE:SAIC), worth close to $73.8 million, amounting to 0.1% of its total 13F portfolio. On Millennium Management’s heels is Citadel Investment Group, led by Ken Griffin, holding a $73.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other peers that are bullish encompass Murray Stahl’s Horizon Asset Management, Phill Gross and Robert Atchinson’s Adage Capital Management and Jeffrey Jacobowitz’s Simcoe Capital Management. In terms of the portfolio weights assigned to each position Simcoe Capital Management allocated the biggest weight to Science Applications International Corp (NYSE:SAIC), around 6.16% of its 13F portfolio. Horizon Asset Management is also relatively very bullish on the stock, designating 1.5 percent of its 13F equity portfolio to SAIC.

Judging by the fact that Science Applications International Corp (NYSE:SAIC) has experienced falling interest from the entirety of the hedge funds we track, logic holds that there is a sect of hedgies that slashed their entire stakes in the third quarter. Interestingly, Clint Carlson’s Carlson Capital said goodbye to the largest position of the 750 funds monitored by Insider Monkey, totaling close to $35.5 million in stock. Scott Kapnick’s fund, HPS Investment Partners, also said goodbye to its stock, about $27.3 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to Science Applications International Corp (NYSE:SAIC). We will take a look at MKS Instruments, Inc. (NASDAQ:MKSI), Capri Holdings Limited (NYSE:CPRI), First Industrial Realty Trust, Inc. (NYSE:FR), and PS Business Parks Inc (NYSE:PSB). This group of stocks’ market values resemble SAIC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MKSI | 17 | 411513 | -2 |

| CPRI | 37 | 920218 | 2 |

| FR | 16 | 240768 | -2 |

| PSB | 17 | 60032 | 3 |

| Average | 21.75 | 408133 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $408 million. That figure was $351 million in SAIC’s case. Capri Holdings Limited (NYSE:CPRI) is the most popular stock in this table. On the other hand First Industrial Realty Trust, Inc. (NYSE:FR) is the least popular one with only 16 bullish hedge fund positions. Science Applications International Corp (NYSE:SAIC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on SAIC, though not to the same extent, as the stock returned 39.1% during 2019 and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.