Stocks, especially the once high flying technology stocks, had a lousy start to the new year. QQQ lost 9% of its value in January. We aren’t certain about the bubbly technology stocks that trade for ridiculously high multiples of their revenues, but we believe top hedge fund stocks will deliver positive returns for the rest of the year. In this article, we will take a closer look at hedge fund sentiment towards Voya Financial Inc (NYSE:VOYA) at the end of the third quarter and determine whether the smart money was really smart about this stock.

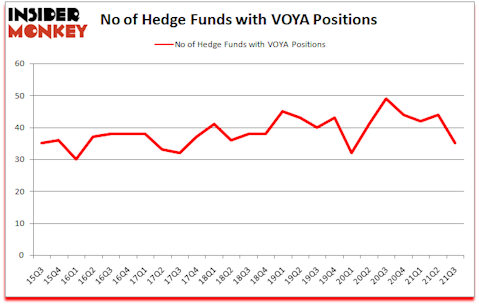

Is Voya Financial Inc (NYSE:VOYA) a buy, sell, or hold? The smart money was in a pessimistic mood. The number of long hedge fund bets retreated by 9 in recent months. Voya Financial Inc (NYSE:VOYA) was in 35 hedge funds’ portfolios at the end of September. The all time high for this statistic is 49. Our calculations also showed that VOYA isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s take a glance at the new hedge fund action encompassing Voya Financial Inc (NYSE:VOYA).

Robert Pohly of Samlyn Capital

Do Hedge Funds Think VOYA Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from the previous quarter. By comparison, 49 hedge funds held shares or bullish call options in VOYA a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Pzena Investment Management, managed by Richard S. Pzena, holds the most valuable position in Voya Financial Inc (NYSE:VOYA). Pzena Investment Management has a $295.3 million position in the stock, comprising 1.2% of its 13F portfolio. Sitting at the No. 2 spot is Robert Pohly of Samlyn Capital, with a $253.9 million position; the fund has 3.4% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish encompass Michael A. Price and Amos Meron’s Empyrean Capital Partners, Ian Simm’s Impax Asset Management and John Murphy’s Levin Easterly Partners. In terms of the portfolio weights assigned to each position BlueMar Capital Management allocated the biggest weight to Voya Financial Inc (NYSE:VOYA), around 3.86% of its 13F portfolio. Levin Easterly Partners is also relatively very bullish on the stock, designating 3.73 percent of its 13F equity portfolio to VOYA.

Seeing as Voya Financial Inc (NYSE:VOYA) has faced bearish sentiment from the entirety of the hedge funds we track, we can see that there were a few money managers who were dropping their full holdings heading into Q4. Interestingly, Dmitry Balyasny’s Balyasny Asset Management sold off the largest position of the “upper crust” of funds monitored by Insider Monkey, worth about $36.3 million in stock. Ryan Tolkin (CIO)’s fund, Schonfeld Strategic Advisors, also sold off its stock, about $16.6 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 9 funds heading into Q4.

Let’s check out hedge fund activity in other stocks similar to Voya Financial Inc (NYSE:VOYA). We will take a look at Woori Financial Group Inc. (NYSE:WF), Chart Industries, Inc. (NYSE:GTLS), BlackLine, Inc. (NASDAQ:BL), Nielsen Holdings plc (NYSE:NLSN), The Descartes Systems Group Inc (NASDAQ:DSGX), Littelfuse, Inc. (NASDAQ:LFUS), and Colfax Corporation (NYSE:CFX). This group of stocks’ market values match VOYA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WF | 2 | 3608 | 0 |

| GTLS | 22 | 350268 | -5 |

| BL | 18 | 326955 | -2 |

| NLSN | 24 | 1476397 | -4 |

| DSGX | 14 | 379447 | -1 |

| LFUS | 24 | 526040 | -3 |

| CFX | 23 | 819033 | -8 |

| Average | 18.1 | 554535 | -3.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.1 hedge funds with bullish positions and the average amount invested in these stocks was $555 million. That figure was $968 million in VOYA’s case. Nielsen Holdings plc (NYSE:NLSN) is the most popular stock in this table. On the other hand Woori Financial Group Inc. (NYSE:WF) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Voya Financial Inc (NYSE:VOYA) is more popular among hedge funds. Our overall hedge fund sentiment score for VOYA is 67.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 29.6% in 2021 and managed to beat the market by another 3.6 percentage points. Hedge funds were also right about betting on VOYA as the stock returned 11% since the end of September (through 1/31) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Voya Financial Inc. (NYSE:VOYA)

Follow Voya Financial Inc. (NYSE:VOYA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Dow Stocks To Buy Now

- 20 Largest Insurance Companies In The US

- 15 Oldest Companies In The World

Disclosure: None. This article was originally published at Insider Monkey.