The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Clovis Oncology Inc (NASDAQ:CLVS). Clovis lost more than 60% in October and we have seen two hedge funds significantly boosting their holdings. Steven Boyd’s Armistice Capital started buying Clovis shares at $34 all the way down to $14. Armistice Capital now owns 9.8% of the outstanding shares. Stephen DuBois’ Camber Management has been buying shares as the stock took a dive and increased its holdings to 3.5 million shares through October 22nd.

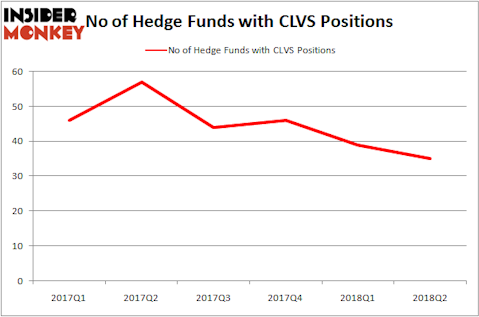

Clovis Oncology Inc (NASDAQ:CLVS) was in 35 hedge funds’ portfolios at the end of June. CLVS investors should be aware of a decrease in enthusiasm from smart money lately. There were 39 hedge funds in our database with CLVS positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the fresh hedge fund action regarding Clovis Oncology Inc (NASDAQ:CLVS).

How have hedgies been trading Clovis Oncology Inc (NASDAQ:CLVS)?

At the end of the third quarter, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CLVS over the last 6 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Palo Alto Investors, managed by William Leland Edwards, holds the biggest position in Clovis Oncology Inc (NASDAQ:CLVS). Palo Alto Investors has a $226.2 million position in the stock, comprising 9% of its 13F portfolio. Sitting at the No. 2 spot is Point State Capital, led by Zach Schreiber, holding a $138.5 million position; the fund has 1.6% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors with similar optimism contain John W. Rende’s Copernicus Capital Management, Jeremy Green’s Redmile Group and Behzad Aghazadeh’s venBio Select Advisor.

Due to the fact that Clovis Oncology Inc (NASDAQ:CLVS) has faced a decline in interest from the entirety of the hedge funds we track, logic holds that there exists a select few fund managers that decided to sell off their entire stakes in the second quarter. Intriguingly, Robert Pohly’s Samlyn Capital sold off the biggest stake of the “upper crust” of funds tracked by Insider Monkey, comprising an estimated $16.3 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund said goodbye to about $13.6 million worth. These transactions are important to note, as total hedge fund interest fell by 4 funds in the second quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Clovis Oncology Inc (NASDAQ:CLVS) but similarly valued. These stocks are Ericsson (ADR) (NASDAQ:ERIC), Washington Real Estate Investment Trust (NYSE:WRE), KB Home (NYSE:KBH), and NetScout Systems, Inc. (NASDAQ:NTCT). This group of stocks’ market caps are similar to CLVS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ERIC | 10 | 104080 | 0 |

| WRE | 9 | 106264 | 1 |

| KBH | 14 | 315485 | -6 |

| NTCT | 14 | 159984 | -3 |

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $171 million. That figure was $976 million in CLVS’s case. KB Home (NYSE:KBH) is the most popular stock in this table. On the other hand Washington Real Estate Investment Trust (NYSE:WRE) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Clovis Oncology Inc (NASDAQ:CLVS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers and the bad news about the stock is already priced in, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.