It has been a fantastic year for equity investors as Donald Trump pressured Federal Reserve to reduce interest rates and finalized the first leg of a trade deal with China. If you were a passive index fund investor, you had seen gains of 31% in your equity portfolio in 2019. However, if you were an active investor putting your money into hedge funds’ favorite stocks, you had seen gains of more than 41%. In this article we are going to take a look at how hedge funds feel about a stock like Hologic, Inc. (NASDAQ:HOLX) and compare its performance against hedge funds’ favorite stocks.

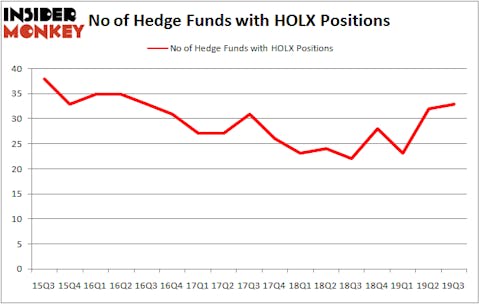

Is Hologic, Inc. (NASDAQ:HOLX) a buy right now? Money managers are getting more optimistic. The number of bullish hedge fund bets inched up by 1 lately. Our calculations also showed that HOLX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings). HOLX was in 33 hedge funds’ portfolios at the end of the third quarter of 2019. There were 32 hedge funds in our database with HOLX positions at the end of the previous quarter.

Today there are tons of indicators stock market investors can use to appraise stocks. A couple of the less utilized indicators are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the top money managers can outperform the market by a superb amount (see the details here).

Matthew Hulsizer of PEAK6 Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now we’re going to check out the recent hedge fund action surrounding Hologic, Inc. (NASDAQ:HOLX).

Hedge fund activity in Hologic, Inc. (NASDAQ:HOLX)

At Q3’s end, a total of 33 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from one quarter earlier. On the other hand, there were a total of 22 hedge funds with a bullish position in HOLX a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Hologic, Inc. (NASDAQ:HOLX) was held by Glenview Capital, which reported holding $414.5 million worth of stock at the end of September. It was followed by D E Shaw with a $104.3 million position. Other investors bullish on the company included Citadel Investment Group, GLG Partners, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Glenview Capital allocated the biggest weight to Hologic, Inc. (NASDAQ:HOLX), around 4.36% of its 13F portfolio. Tamarack Capital Management is also relatively very bullish on the stock, dishing out 3.68 percent of its 13F equity portfolio to HOLX.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Healthcor Management, managed by Arthur B Cohen and Joseph Healey, established the biggest position in Hologic, Inc. (NASDAQ:HOLX). Healthcor Management had $40.9 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace also made a $33.2 million investment in the stock during the quarter. The following funds were also among the new HOLX investors: Mike Vranos’s Ellington, George Zweig, Shane Haas and Ravi Chander’s Signition LP, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Hologic, Inc. (NASDAQ:HOLX) but similarly valued. These stocks are Sun Communities Inc (NYSE:SUI), Atmos Energy Corporation (NYSE:ATO), Cna Financial Corporation (NYSE:CNA), and The Liberty SiriusXM Group (NASDAQ:LSXMK). This group of stocks’ market valuations match HOLX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SUI | 15 | 303237 | -5 |

| ATO | 19 | 407896 | 5 |

| CNA | 14 | 86638 | 2 |

| LSXMK | 44 | 2852514 | 2 |

| Average | 23 | 912571 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $913 million. That figure was $1018 million in HOLX’s case. The Liberty SiriusXM Group (NASDAQ:LSXMK) is the most popular stock in this table. On the other hand Cna Financial Corporation (NYSE:CNA) is the least popular one with only 14 bullish hedge fund positions. Hologic, Inc. (NASDAQ:HOLX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately HOLX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HOLX were disappointed as the stock returned 27% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.