Diamond Hill Capital, an investment management company, released its “Large Cap Strategy” second-quarter 2023 investor letter. A copy of the same can be downloaded here. In the second quarter, the strategy underperformed the Russell 1000 Index. With the revival of growth and technology stocks, the strategy’s underweight exposure to the sector was a headwind on the relative performance. Technology and communication services holdings of the strategy collectively performed well but did not keep pace with those in the index. It benefited from the strength of investments in the materials and consumer discretionary sectors. The strategy returned 6.04% (net) in the quarter compared to 8.58% for the index. In addition, you can check the top 5 holdings of the strategy to know its best picks in 2023.

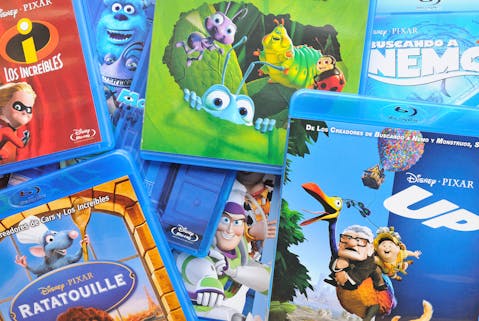

Diamond Hill Large Cap Strategy highlighted stocks like The Walt Disney Company (NYSE:DIS) in the second quarter 2023 investor letter. Headquartered in Burbank, California, The Walt Disney Company (NYSE:DIS) is an entertainment company that operates through Disney Media and Entertainment Distribution; and Disney Parks, Experiences, and Products. On September 14, 2023, The Walt Disney Company (NYSE:DIS) stock closed at $84.48 per share. One-month return of The Walt Disney Company (NYSE:DIS) was -1.72%, and its shares lost 21.96% of their value over the last 52 weeks. The Walt Disney Company (NYSE:DIS) has a market capitalization of $154.58 billion.

Diamond Hill Large Cap Strategy made the following comment about The Walt Disney Company (NYSE:DIS) in its Q2 2023 investor letter:

“Our bottom contributors in Q2 included health insurance company Humana, biopharmaceutical company Pfizer and global entertainment company The Walt Disney Company (NYSE:DIS). Disney’s Bob Iger returned to the CEO’s seat in November 2022, replacing Bob Chapek, who left following a turbulent tenure. As a result of disappointing quarterly results and incremental commentary suggesting a more inline strategy with other media, the market has become less confident that Iger will achieve a turnaround by the end of his 1.5- year contract. We continue to believe Disney has a unique collection of assets and owns some of the best content among all media companies. Their ability to monetize this content across many platforms — studio, theme park, toys, streaming — is incredibly valuable; thus we remain investors.”

Christian Bertrand / Shutterstock.com

The Walt Disney Company (NYSE:DIS) is in 21st position on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 92 hedge fund portfolios held The Walt Disney Company (NYSE:DIS) at the end of second quarter which was 95 in the previous quarter.

We discussed The Walt Disney Company (NYSE:DIS) in another article and shared the list of good stocks to invest in. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 25 Most Admired Companies in 2023

- 12 Cheapest Places to Retire in Switzerland

- 25 Most Produced Foods in the World

Disclosure: None. This article is originally published at Insider Monkey.