White Falcon Capital Management, an investment fund manager, released its second quarter 2023 investor letter. A copy of the same can be downloaded here. In the second quarter, the fund was up 6.9% compared to the S&P 500 (CAD), the MSCI All Country (CAD), and the S&P TSX’s returns of 6.5%, 3.9%, and 1.2%, respectively. In the second quarter, the portfolio benefited from the rise in technology stocks. In addition, please check the fund’s top five holdings to know its best picks in 2023.

White Falcon Capital Management highlighted stocks like Advanced Micro Devices, Inc. (NASDAQ:AMD) in the second quarter 2023 investor letter. Headquartered in Santa Clara, California, Advanced Micro Devices, Inc. (NASDAQ:AMD) is a semiconductor company. On July 14, 2023, Advanced Micro Devices, Inc. (NASDAQ:AMD) stock closed at $115.94 per share. One-month return of Advanced Micro Devices, Inc. (NASDAQ:AMD) was -3.45%, and its shares gained 42.38% of their value over the last 52 weeks. Advanced Micro Devices, Inc. (NASDAQ:AMD) has a market capitalization of $186.705 billion.

White Falcon Capital Management made the following comment about Advanced Micro Devices, Inc. (NASDAQ:AMD) in its second quarter 2023 investor letter:

“Advanced Micro Devices, Inc. (NASDAQ:AMD): Under CEO Lisa Su, AMD has made one successful bet after another – both on technology and strategy. Chiplet architecture, advanced 3D packaging, modularity and adaptability in chip design, strong TSMC partnership for leading nodes all helped AMD differentiate itself in the marketplace. We also liked the fact that AMD was diversified in product lines as well as end markets. Further, it was free cash flow positive at the bottom of the cycle and had a net-cash balance sheet. AMD was a secularly growing company that was facing cyclical issues available at 18x earnings, and these earnings had been revised down several times. The risk was that further revision in earnings will be needed and we were happy to buy more if that was the case. Today, the stock is more than fully valued but Nvidia’s guide and AMD’s optionality in GPU’s give us second thoughts in trimming more.”

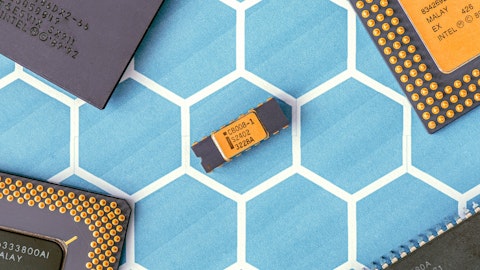

l-n-r2tVRjxzFM8-unsplash

Advanced Micro Devices, Inc. (NASDAQ:AMD) is in 23rd position on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 91 hedge fund portfolios held Advanced Micro Devices, Inc. (NASDAQ:AMD) at the end of first quarter 2023 which was 97 in the previous quarter.

We discussed Advanced Micro Devices, Inc. (NASDAQ:AMD) in another article and shared Citigroup’s top AI Stocks to Buy. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 16 Best Places to Retire in California in 2023

- 22 Cool Jobs You Have Never Heard Of

- 15 Countries with Most Faithful Wives in the World

Disclosure: None. This article is originally published at Insider Monkey.