The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Williams-Sonoma, Inc. (NYSE:WSM) from the perspective of those elite funds.

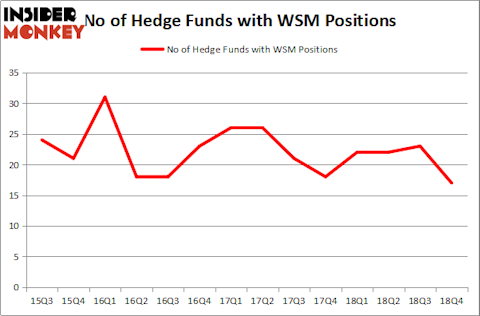

Williams-Sonoma, Inc. (NYSE:WSM) investors should be aware of a decrease in support from the world’s most elite money managers in recent months. WSM was in 17 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 23 hedge funds in our database with WSM holdings at the end of the previous quarter. Our calculations also showed that WSM isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the recent hedge fund action regarding Williams-Sonoma, Inc. (NYSE:WSM).

Hedge fund activity in Williams-Sonoma, Inc. (NYSE:WSM)

At Q4’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -26% from the second quarter of 2018. On the other hand, there were a total of 22 hedge funds with a bullish position in WSM a year ago. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Select Equity Group held the most valuable stake in Williams-Sonoma, Inc. (NYSE:WSM), which was worth $143.7 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $81.2 million worth of shares. Moreover, Maverick Capital, Two Sigma Advisors, and Citadel Investment Group were also bullish on Williams-Sonoma, Inc. (NYSE:WSM), allocating a large percentage of their portfolios to this stock.

Since Williams-Sonoma, Inc. (NYSE:WSM) has experienced bearish sentiment from the smart money, it’s easy to see that there was a specific group of fund managers that slashed their full holdings heading into Q3. At the top of the heap, Jim Simons’s Renaissance Technologies cut the biggest stake of the “upper crust” of funds tracked by Insider Monkey, valued at an estimated $51.1 million in stock. David Harding’s fund, Winton Capital Management, also cut its stock, about $11 million worth. These transactions are interesting, as total hedge fund interest fell by 6 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Williams-Sonoma, Inc. (NYSE:WSM) but similarly valued. These stocks are CIT Group Inc. (NYSE:CIT), Amneal Pharmaceuticals, Inc. (NYSE:AMRX), Kirby Corporation (NYSE:KEX), and nVent Electric plc (NYSE:NVT). This group of stocks’ market values resemble WSM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CIT | 26 | 600235 | 1 |

| AMRX | 8 | 75987 | -3 |

| KEX | 16 | 409084 | 0 |

| NVT | 28 | 1015805 | -1 |

| Average | 19.5 | 525278 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $525 million. That figure was $284 million in WSM’s case. nVent Electric plc (NYSE:NVT) is the most popular stock in this table. On the other hand Amneal Pharmaceuticals, Inc. (NYSE:AMRX) is the least popular one with only 8 bullish hedge fund positions. Williams-Sonoma, Inc. (NYSE:WSM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately WSM wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); WSM investors were disappointed as the stock returned 12.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.