You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Is WestAmerica Bancorp. (NASDAQ:WABC) a buy, sell, or hold? Money managers are becoming hopeful. The number of long hedge fund positions inched up by 1 lately. Our calculations also showed that WABC isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the key hedge fund action surrounding WestAmerica Bancorp. (NASDAQ:WABC).

How have hedgies been trading WestAmerica Bancorp. (NASDAQ:WABC)?

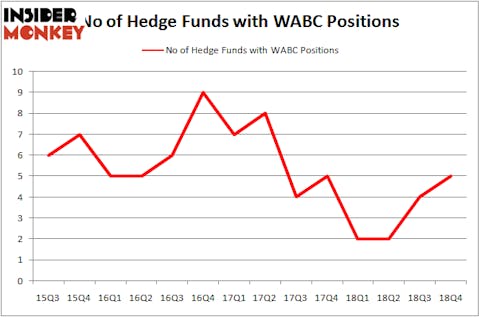

Heading into the first quarter of 2019, a total of 5 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 25% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards WABC over the last 14 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Balyasny Asset Management, managed by Dmitry Balyasny, holds the largest position in WestAmerica Bancorp. (NASDAQ:WABC). Balyasny Asset Management has a $2.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second most bullish fund manager is Two Sigma Advisors, led by John Overdeck and David Siegel, holding a $1.3 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other peers that are bullish contain Paul Tudor Jones’s Tudor Investment Corp, and Brandon Haley’s Holocene Advisors.

As aggregate interest increased, specific money managers were breaking ground themselves. Balyasny Asset Management, managed by Dmitry Balyasny, created the most valuable position in WestAmerica Bancorp. (NASDAQ:WABC). Balyasny Asset Management had $2.1 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.4 million position during the quarter. The only other fund with a brand new WABC position is Benjamin A. Smith’s Laurion Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as WestAmerica Bancorp. (NASDAQ:WABC) but similarly valued. These stocks are Aimmune Therapeutics Inc (NASDAQ:AIMT), Callon Petroleum Company (NYSE:CPE), Spark Therapeutics Inc (NASDAQ:ONCE), and FGL Holdings (NYSE:FG). This group of stocks’ market values are closest to WABC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AIMT | 16 | 188597 | -2 |

| CPE | 22 | 175464 | -4 |

| ONCE | 15 | 329072 | -6 |

| FG | 29 | 207993 | 1 |

| Average | 20.5 | 225282 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $225 million. That figure was $4 million in WABC’s case. FGL Holdings (NYSE:FG) is the most popular stock in this table. On the other hand Spark Therapeutics Inc (NASDAQ:ONCE) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks WestAmerica Bancorp. (NASDAQ:WABC) is even less popular than ONCE. Hedge funds dodged a bullet by taking a bearish stance towards WABC. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately WABC wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); WABC investors were disappointed as the stock returned 13.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.