With the fourth-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the first quarter. One of these stocks was VEON Ltd. (NASDAQ:VEON).

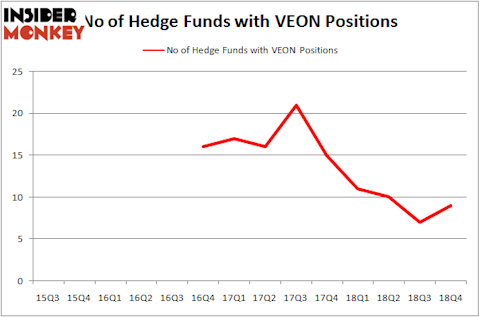

VEON Ltd. (NASDAQ:VEON) was in 9 hedge funds’ portfolios at the end of the fourth quarter of 2018. VEON has experienced an increase in hedge fund sentiment recently. There were 7 hedge funds in our database with VEON positions at the end of the previous quarter. Our calculations also showed that VEON isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are several tools stock market investors can use to assess publicly traded companies. Two of the most useful tools are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the best money managers can trounce their index-focused peers by a solid amount (see the details here).

We’re going to go over the latest hedge fund action regarding VEON Ltd. (NASDAQ:VEON).

Hedge fund activity in VEON Ltd. (NASDAQ:VEON)

At Q4’s end, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 29% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in VEON over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Marshall Wace LLP was the largest shareholder of VEON Ltd. (NASDAQ:VEON), with a stake worth $7.1 million reported as of the end of September. Trailing Marshall Wace LLP was Arrowstreet Capital, which amassed a stake valued at $5.8 million. Citadel Investment Group, Oaktree Capital Management, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, some big names have been driving this bullishness. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most valuable position in VEON Ltd. (NASDAQ:VEON). Marshall Wace LLP had $7.1 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $5.8 million position during the quarter. The other funds with new positions in the stock are Jim Simons’s Renaissance Technologies and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s check out hedge fund activity in other stocks similar to VEON Ltd. (NASDAQ:VEON). We will take a look at Portland General Electric Company (NYSE:POR), Tesaro Inc (NASDAQ:TSRO), Gardner Denver Holdings, Inc. (NYSE:GDI), and Bilibili Inc. (NASDAQ:BILI). This group of stocks’ market caps resemble VEON’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| POR | 19 | 249916 | 3 |

| TSRO | 39 | 1357819 | 19 |

| GDI | 27 | 362231 | 3 |

| BILI | 20 | 320474 | 4 |

| Average | 26.25 | 572610 | 7.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $573 million. That figure was $28 million in VEON’s case. Tesaro Inc (NASDAQ:TSRO) is the most popular stock in this table. On the other hand Portland General Electric Company (NYSE:POR) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks VEON Ltd. (NASDAQ:VEON) is even less popular than POR. Hedge funds dodged a bullet by taking a bearish stance towards VEON. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately VEON wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); VEON investors were disappointed as the stock returned 7.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.