Is Tucows Inc. (NASDAQ:TCX) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

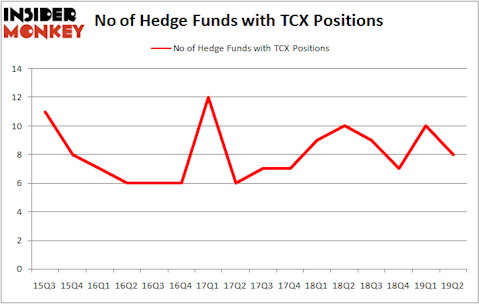

Is Tucows Inc. (NASDAQ:TCX) worth your attention right now? The smart money is taking a pessimistic view. The number of long hedge fund positions dropped by 2 recently. Our calculations also showed that TCX isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the new hedge fund action regarding Tucows Inc. (NASDAQ:TCX).

Hedge fund activity in Tucows Inc. (NASDAQ:TCX)

At Q2’s end, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards TCX over the last 16 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in Tucows Inc. (NASDAQ:TCX) was held by Renaissance Technologies, which reported holding $31.3 million worth of stock at the end of March. It was followed by Osmium Partners with a $8.7 million position. Other investors bullish on the company included Arrowstreet Capital, Osmium Partners, and Citadel Investment Group.

Due to the fact that Tucows Inc. (NASDAQ:TCX) has witnessed a decline in interest from the aggregate hedge fund industry, we can see that there lies a certain “tier” of hedgies that slashed their positions entirely last quarter. At the top of the heap, Matthew Hulsizer’s PEAK6 Capital Management cut the biggest position of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $1.1 million in stock. Israel Englander’s fund, Millennium Management, also sold off its stock, about $0.5 million worth. These moves are important to note, as total hedge fund interest was cut by 2 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Tucows Inc. (NASDAQ:TCX) but similarly valued. We will take a look at Universal Logistics Holdings, Inc. (NASDAQ:ULH), NextDecade Corporation (NASDAQ:NEXT), Hersha Hospitality Trust (NYSE:HT), and Verso Corporation (NYSE:VRS). This group of stocks’ market caps resemble TCX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ULH | 13 | 28485 | 3 |

| NEXT | 9 | 535292 | 2 |

| HT | 12 | 23778 | 0 |

| VRS | 22 | 138980 | -2 |

| Average | 14 | 181634 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $182 million. That figure was $50 million in TCX’s case. Verso Corporation (NYSE:VRS) is the most popular stock in this table. On the other hand NextDecade Corporation (NASDAQ:NEXT) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Tucows Inc. (NASDAQ:TCX) is even less popular than NEXT. Hedge funds dodged a bullet by taking a bearish stance towards TCX. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately TCX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); TCX investors were disappointed as the stock returned -11.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.