Insider Monkey has processed numerous 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of The Middleby Corporation (NASDAQ:MIDD) based on that data.

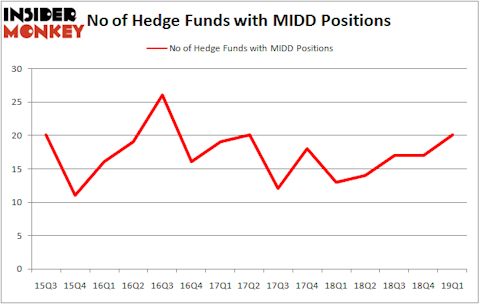

The Middleby Corporation (NASDAQ:MIDD) investors should be aware of an increase in hedge fund interest recently. MIDD was in 20 hedge funds’ portfolios at the end of March. There were 17 hedge funds in our database with MIDD positions at the end of the previous quarter. Our calculations also showed that MIDD isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the latest hedge fund action regarding The Middleby Corporation (NASDAQ:MIDD).

What does the smart money think about The Middleby Corporation (NASDAQ:MIDD)?

At Q1’s end, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from the previous quarter. By comparison, 13 hedge funds held shares or bullish call options in MIDD a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Bares Capital Management was the largest shareholder of The Middleby Corporation (NASDAQ:MIDD), with a stake worth $268.9 million reported as of the end of March. Trailing Bares Capital Management was Viking Global, which amassed a stake valued at $80.9 million. D E Shaw, Echo Street Capital Management, and Columbus Circle Investors were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key money managers were leading the bulls’ herd. Columbus Circle Investors, managed by Principal Global Investors, established the most outsized position in The Middleby Corporation (NASDAQ:MIDD). Columbus Circle Investors had $37.8 million invested in the company at the end of the quarter. Mark Kingdon’s Kingdon Capital also made a $34.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Ricky Sandler’s Eminence Capital, Elise Di Vincenzo Crumbine’s Stormborn Capital Management, and Ira Unschuld’s Brant Point Investment Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as The Middleby Corporation (NASDAQ:MIDD) but similarly valued. These stocks are Companhia de Saneamento Básico do Estado de São Paulo – SABESP (NYSE:SBS), PRA Health Sciences Inc (NASDAQ:PRAH), Ceridian HCM Holding Inc. (NYSE:CDAY), and Universal Display Corporation (NASDAQ:OLED). All of these stocks’ market caps match MIDD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SBS | 16 | 330259 | -1 |

| PRAH | 28 | 411788 | 3 |

| CDAY | 30 | 987099 | 13 |

| OLED | 18 | 133100 | 8 |

| Average | 23 | 465562 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $466 million. That figure was $656 million in MIDD’s case. Ceridian HCM Holding Inc. (NYSE:CDAY) is the most popular stock in this table. On the other hand Companhia de Saneamento Básico do Estado de São Paulo – SABESP (NYSE:SBS) is the least popular one with only 16 bullish hedge fund positions. The Middleby Corporation (NASDAQ:MIDD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on MIDD as the stock returned 2.5% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.