Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of December. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is The Madison Square Garden Company (NYSE:MSG), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

Is The Madison Square Garden Company (NYSE:MSG) an outstanding investment right now? Hedge funds are buying. The number of long hedge fund bets advanced by 6 lately. Our calculations also showed that MSG isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to check out the new hedge fund action surrounding The Madison Square Garden Company (NYSE:MSG).

How have hedgies been trading The Madison Square Garden Company (NYSE:MSG)?

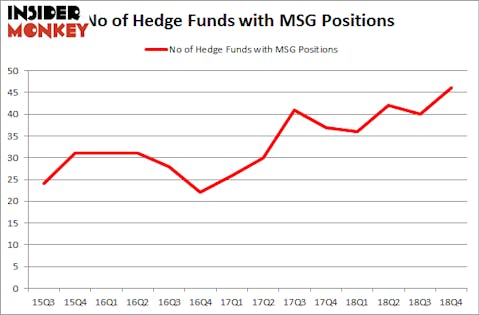

Heading into the first quarter of 2019, a total of 46 of the hedge funds tracked by Insider Monkey were long this stock, a change of 15% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in MSG over the last 14 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Davidson, Dave Roux and Glenn Hutchins’s Silver Lake Partners has the number one position in The Madison Square Garden Company (NYSE:MSG), worth close to $499.5 million, accounting for 12.2% of its total 13F portfolio. Coming in second is Mario Gabelli of GAMCO Investors, with a $212.7 million position; 1.8% of its 13F portfolio is allocated to the company. Some other peers that hold long positions include Clifton S. Robbins’s Blue Harbour Group, Ken Griffin’s Citadel Investment Group and Robert Pohly’s Samlyn Capital.

Consequently, some big names were breaking ground themselves. Blue Harbour Group, managed by Clifton S. Robbins, assembled the biggest position in The Madison Square Garden Company (NYSE:MSG). Blue Harbour Group had $117.8 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also initiated a $73.6 million position during the quarter. The other funds with brand new MSG positions are Matthew Knauer and Mina Faltas’s Nokota Management, Michael Gelband’s ExodusPoint Capital, and Lee Ainslie’s Maverick Capital.

Let’s check out hedge fund activity in other stocks similar to The Madison Square Garden Company (NYSE:MSG). We will take a look at Kilroy Realty Corp (NYSE:KRC), Santander Consumer USA Holdings Inc (NYSE:SC), East West Bancorp, Inc. (NASDAQ:EWBC), and Dolby Laboratories, Inc. (NYSE:DLB). All of these stocks’ market caps resemble MSG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KRC | 13 | 178217 | 1 |

| SC | 21 | 565375 | -5 |

| EWBC | 27 | 461953 | -2 |

| DLB | 23 | 493936 | -6 |

| Average | 21 | 424870 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $425 million. That figure was $1734 million in MSG’s case. East West Bancorp, Inc. (NASDAQ:EWBC) is the most popular stock in this table. On the other hand Kilroy Realty Corp (NYSE:KRC) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks The Madison Square Garden Company (NYSE:MSG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately MSG wasn’t in this group. Hedge funds that bet on MSG were disappointed as the stock returned 10.9% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.