Insider Monkey has processed numerous 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Stoneridge, Inc. (NYSE:SRI) based on that data.

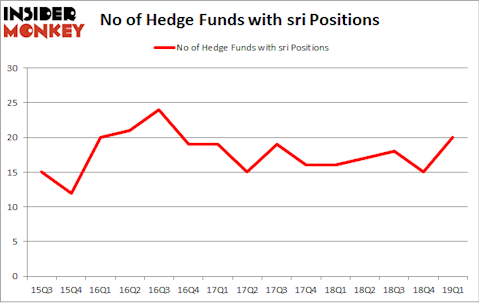

Stoneridge, Inc. (NYSE:SRI) has seen an increase in hedge fund sentiment in recent months. Our calculations also showed that sri isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are dozens of tools stock market investors can use to assess stocks. A duo of the most underrated tools are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best hedge fund managers can trounce the S&P 500 by a solid margin (see the details here).

We’re going to analyze the fresh hedge fund action regarding Stoneridge, Inc. (NYSE:SRI).

Hedge fund activity in Stoneridge, Inc. (NYSE:SRI)

At Q1’s end, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from the fourth quarter of 2018. By comparison, 16 hedge funds held shares or bullish call options in SRI a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Chuck Royce’s Royce & Associates has the number one position in Stoneridge, Inc. (NYSE:SRI), worth close to $24.6 million, corresponding to 0.2% of its total 13F portfolio. The second largest stake is held by Renaissance Technologies, managed by Jim Simons, which holds a $18.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that are bullish contain George McCabe’s Portolan Capital Management, Gregg J. Powers’s Private Capital Management and Mario Gabelli’s GAMCO Investors.

As industrywide interest jumped, some big names have been driving this bullishness. Portolan Capital Management, managed by George McCabe, initiated the biggest position in Stoneridge, Inc. (NYSE:SRI). Portolan Capital Management had $14.3 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $5 million investment in the stock during the quarter. The following funds were also among the new SRI investors: Charles Davidson and Joseph Jacobs’s Wexford Capital, Hoon Kim’s Quantinno Capital, and Jay Petschek and Steven Major’s Corsair Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Stoneridge, Inc. (NYSE:SRI) but similarly valued. We will take a look at Ambac Financial Group, Inc. (NASDAQ:AMBC), Athenex, Inc. (NASDAQ:ATNX), AxoGen, Inc. (NASDAQ:AXGN), and Renewable Energy Group Inc (NASDAQ:REGI). This group of stocks’ market values match SRI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMBC | 19 | 125635 | 2 |

| ATNX | 8 | 87665 | -2 |

| AXGN | 19 | 129818 | 1 |

| REGI | 19 | 84797 | 1 |

| Average | 16.25 | 106979 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $107 million. That figure was $101 million in SRI’s case. Ambac Financial Group, Inc. (NASDAQ:AMBC) is the most popular stock in this table. On the other hand Athenex, Inc. (NASDAQ:ATNX) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Stoneridge, Inc. (NYSE:SRI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately SRI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SRI were disappointed as the stock returned -7.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.