The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Stoneridge, Inc. (NYSE:SRI) from the perspective of those elite funds.

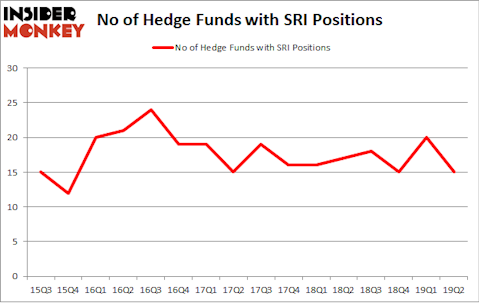

Stoneridge, Inc. (NYSE:SRI) was in 15 hedge funds’ portfolios at the end of June. SRI has seen a decrease in enthusiasm from smart money recently. There were 20 hedge funds in our database with SRI positions at the end of the previous quarter. Our calculations also showed that SRI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most shareholders, hedge funds are assumed to be worthless, outdated financial tools of years past. While there are over 8000 funds trading at present, Our researchers choose to focus on the elite of this club, around 750 funds. It is estimated that this group of investors command most of the smart money’s total capital, and by keeping track of their highest performing equity investments, Insider Monkey has come up with a number of investment strategies that have historically beaten the market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the recent hedge fund action surrounding Stoneridge, Inc. (NYSE:SRI).

How are hedge funds trading Stoneridge, Inc. (NYSE:SRI)?

At Q2’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SRI over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Royce & Associates held the most valuable stake in Stoneridge, Inc. (NYSE:SRI), which was worth $19 million at the end of the second quarter. On the second spot was Renaissance Technologies which amassed $18.1 million worth of shares. Moreover, Private Capital Management, GAMCO Investors, and Driehaus Capital were also bullish on Stoneridge, Inc. (NYSE:SRI), allocating a large percentage of their portfolios to this stock.

Due to the fact that Stoneridge, Inc. (NYSE:SRI) has faced falling interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of fund managers that slashed their positions entirely by the end of the second quarter. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dumped the largest position of all the hedgies watched by Insider Monkey, comprising an estimated $5 million in stock. Charles Davidson and Joseph Jacobs’s fund, Wexford Capital, also said goodbye to its stock, about $4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 5 funds by the end of the second quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Stoneridge, Inc. (NYSE:SRI) but similarly valued. These stocks are Star Bulk Carriers Corp. (NASDAQ:SBLK), TiVo Corporation (NASDAQ:TIVO), Principia Biopharma Inc. (NASDAQ:PRNB), and Lindsay Corporation (NYSE:LNN). This group of stocks’ market caps are closest to SRI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SBLK | 11 | 449409 | -4 |

| TIVO | 19 | 109995 | 0 |

| PRNB | 12 | 225860 | 1 |

| LNN | 6 | 175783 | -1 |

| Average | 12 | 240262 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $240 million. That figure was $88 million in SRI’s case. TiVo Corporation (NASDAQ:TIVO) is the most popular stock in this table. On the other hand Lindsay Corporation (NYSE:LNN) is the least popular one with only 6 bullish hedge fund positions. Stoneridge, Inc. (NYSE:SRI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately SRI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SRI were disappointed as the stock returned -1.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.