You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

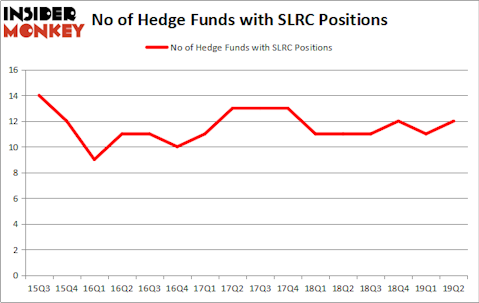

Is Solar Capital Ltd. (NASDAQ:SLRC) a healthy stock for your portfolio? The best stock pickers are getting more optimistic. The number of bullish hedge fund positions improved by 1 recently. Our calculations also showed that SLRC isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are perceived as worthless, old investment tools of the past. While there are greater than 8000 funds with their doors open at the moment, Our researchers look at the moguls of this club, about 750 funds. These hedge fund managers orchestrate the lion’s share of the smart money’s total asset base, and by following their best picks, Insider Monkey has spotted several investment strategies that have historically exceeded the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points a year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the recent hedge fund action surrounding Solar Capital Ltd. (NASDAQ:SLRC).

Hedge fund activity in Solar Capital Ltd. (NASDAQ:SLRC)

At Q2’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from the first quarter of 2019. By comparison, 11 hedge funds held shares or bullish call options in SLRC a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in Solar Capital Ltd. (NASDAQ:SLRC) was held by Clough Capital Partners, which reported holding $16 million worth of stock at the end of March. It was followed by Arrowstreet Capital with a $14.4 million position. Other investors bullish on the company included Polar Capital, McKinley Capital Management, and Marshall Wace LLP.

Now, some big names have jumped into Solar Capital Ltd. (NASDAQ:SLRC) headfirst. Millennium Management, managed by Israel Englander, assembled the most outsized position in Solar Capital Ltd. (NASDAQ:SLRC). Millennium Management had $1.6 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also initiated a $0.2 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Solar Capital Ltd. (NASDAQ:SLRC) but similarly valued. We will take a look at Westlake Chemical Partners LP (NYSE:WLKP), Entercom Communications Corp. (NYSE:ETM), Great Southern Bancorp, Inc. (NASDAQ:GSBC), and Signet Jewelers Limited (NYSE:SIG). This group of stocks’ market values match SLRC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WLKP | 3 | 8610 | 0 |

| ETM | 19 | 79346 | -2 |

| GSBC | 8 | 27726 | -4 |

| SIG | 17 | 62215 | 0 |

| Average | 11.75 | 44474 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $44 million. That figure was $59 million in SLRC’s case. Entercom Communications Corp. (NYSE:ETM) is the most popular stock in this table. On the other hand Westlake Chemical Partners LP (NYSE:WLKP) is the least popular one with only 3 bullish hedge fund positions. Solar Capital Ltd. (NASDAQ:SLRC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on SLRC, though not to the same extent, as the stock returned 2.6% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.