At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Ship Finance International Limited (NYSE:SFL) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of December. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Papa John’s International, Inc. (NASDAQ:PZZA), Builders FirstSource, Inc. (NASDAQ:BLDR), and Safety Insurance Group, Inc. (NASDAQ:SAFT) to gather more data points.

According to most market participants, hedge funds are seen as slow, old financial tools of the past. While there are over 8000 funds with their doors open at present, Our experts hone in on the elite of this club, approximately 750 funds. These hedge fund managers manage most of all hedge funds’ total capital, and by watching their highest performing equity investments, Insider Monkey has figured out several investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a look at the fresh hedge fund action surrounding Ship Finance International Limited (NYSE:SFL).

How have hedgies been trading Ship Finance International Limited (NYSE:SFL)?

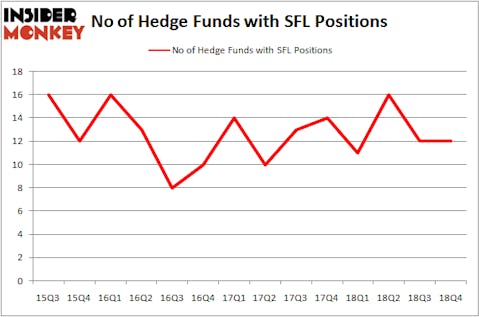

At the end of the fourth quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SFL over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, GLG Partners held the most valuable stake in Ship Finance International Limited (NYSE:SFL), which was worth $6.4 million at the end of the fourth quarter. On the second spot was Millennium Management which amassed $5.4 million worth of shares. Moreover, Renaissance Technologies, Marshall Wace LLP, and Arrowstreet Capital were also bullish on Ship Finance International Limited (NYSE:SFL), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Ship Finance International Limited (NYSE:SFL) has experienced falling interest from the entirety of the hedge funds we track, it’s safe to say that there exists a select few hedge funds that slashed their positions entirely in the third quarter. Interestingly, Joel Greenblatt’s Gotham Asset Management dropped the largest position of the “upper crust” of funds tracked by Insider Monkey, comprising an estimated $1.9 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also cut its stock, about $0.6 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Ship Finance International Limited (NYSE:SFL). We will take a look at Papa John’s International, Inc. (NASDAQ:PZZA), Builders FirstSource, Inc. (NASDAQ:BLDR), Safety Insurance Group, Inc. (NASDAQ:SAFT), and Usa Compression Partners LP (NYSE:USAC). This group of stocks’ market caps are closest to SFL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PZZA | 23 | 209304 | -4 |

| BLDR | 33 | 278783 | -4 |

| SAFT | 11 | 39390 | 0 |

| USAC | 5 | 7007 | 0 |

| Average | 18 | 133621 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $134 million. That figure was $32 million in SFL’s case. Builders FirstSource, Inc. (NASDAQ:BLDR) is the most popular stock in this table. On the other hand Usa Compression Partners LP (NYSE:USAC) is the least popular one with only 5 bullish hedge fund positions. Ship Finance International Limited (NYSE:SFL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on SFL as the stock returned 25.1% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.