Does Repligen Corporation (NASDAQ:RGEN) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

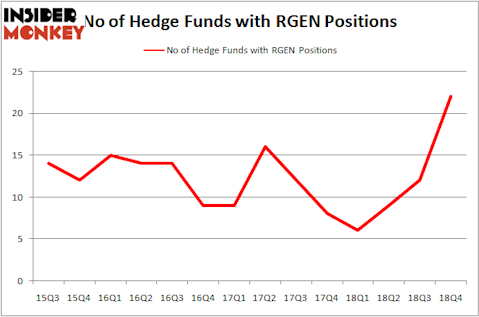

Is Repligen Corporation (NASDAQ:RGEN) going to take off soon? The best stock pickers are turning bullish. The number of bullish hedge fund positions went up by 10 in recent months. Our calculations also showed that RGEN isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the new hedge fund action surrounding Repligen Corporation (NASDAQ:RGEN).

What have hedge funds been doing with Repligen Corporation (NASDAQ:RGEN)?

At Q4’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 83% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards RGEN over the last 14 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, D E Shaw, managed by D. E. Shaw, holds the largest position in Repligen Corporation (NASDAQ:RGEN). D E Shaw has a $14.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Millennium Management, managed by Israel Englander, which holds a $11 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other professional money managers that hold long positions consist of Steve Cohen’s Point72 Asset Management, Jim Simons’s Renaissance Technologies and David Harding’s Winton Capital Management.

As industrywide interest jumped, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, created the largest position in Repligen Corporation (NASDAQ:RGEN). Millennium Management had $11 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also made a $9.5 million investment in the stock during the quarter. The other funds with new positions in the stock are D. E. Shaw’s D E Shaw, Jim Simons’s Renaissance Technologies, and David Harding’s Winton Capital Management.

Let’s check out hedge fund activity in other stocks similar to Repligen Corporation (NASDAQ:RGEN). These stocks are Norbord Inc. (NYSE:OSB), SkyWest, Inc. (NASDAQ:SKYW), Prospect Capital Corporation (NASDAQ:PSEC), and Brandywine Realty Trust (NYSE:BDN). This group of stocks’ market caps are closest to RGEN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OSB | 7 | 18516 | -3 |

| SKYW | 13 | 139280 | -1 |

| PSEC | 11 | 29955 | 0 |

| BDN | 17 | 105044 | 2 |

| Average | 12 | 73199 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $78 million in RGEN’s case. Brandywine Realty Trust (NYSE:BDN) is the most popular stock in this table. On the other hand Norbord Inc. (NYSE:OSB) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Repligen Corporation (NASDAQ:RGEN) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately RGEN wasn’t nearly as popular as these 15 stock and hedge funds that were betting on RGEN were disappointed as the stock returned 3.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.