Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

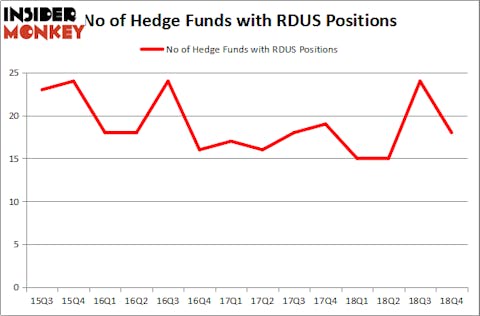

Is Radius Health Inc (NASDAQ:RDUS) a buy right now? Prominent investors are getting less bullish. The number of long hedge fund bets were cut by 6 lately. Our calculations also showed that RDUS isn’t among the 30 most popular stocks among hedge funds. RDUS was in 18 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 24 hedge funds in our database with RDUS holdings at the end of the previous quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to check out the latest hedge fund action encompassing Radius Health Inc (NASDAQ:RDUS).

What does the smart money think about Radius Health Inc (NASDAQ:RDUS)?

At the end of the fourth quarter, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from the previous quarter. The graph below displays the number of hedge funds with bullish position in RDUS over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Healthcor Management LP was the largest shareholder of Radius Health Inc (NASDAQ:RDUS), with a stake worth $59.7 million reported as of the end of December. Trailing Healthcor Management LP was Rubric Capital Management, which amassed a stake valued at $34.6 million. Farallon Capital, Millennium Management, and Rock Springs Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Radius Health Inc (NASDAQ:RDUS) has witnessed bearish sentiment from the smart money, logic holds that there were a few money managers that decided to sell off their entire stakes by the end of the third quarter. At the top of the heap, Steve Cohen’s Point72 Asset Management dropped the largest position of the “upper crust” of funds followed by Insider Monkey, comprising close to $17.8 million in stock. Samuel Isaly’s fund, OrbiMed Advisors, also sold off its stock, about $13.6 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 6 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Radius Health Inc (NASDAQ:RDUS). We will take a look at Regis Corporation (NYSE:RGS), Tekla Healthcare Investors (NYSE:HQH), United Financial Bancorp, Inc. (NASDAQ:UBNK), and AngioDynamics, Inc. (NASDAQ:ANGO). This group of stocks’ market valuations are closest to RDUS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RGS | 12 | 243782 | -3 |

| HQH | 3 | 4208 | 2 |

| UBNK | 7 | 58562 | -6 |

| ANGO | 12 | 46572 | -3 |

| Average | 8.5 | 88281 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $88 million. That figure was $261 million in RDUS’s case. Regis Corporation (NYSE:RGS) is the most popular stock in this table. On the other hand Tekla Healthcare Investors (NYSE:HQH) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Radius Health Inc (NASDAQ:RDUS) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on RDUS as the stock returned 28% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.