We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of Pinnacle Financial Partners, Inc. (NASDAQ:PNFP) based on that data.

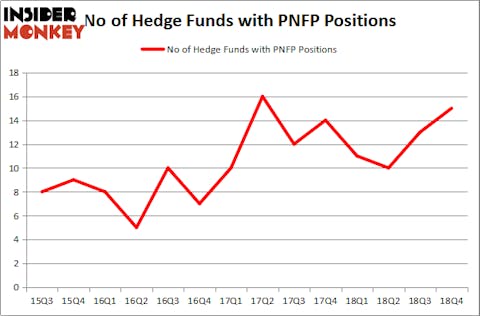

Pinnacle Financial Partners, Inc. (NASDAQ:PNFP) has experienced an increase in enthusiasm from smart money in recent months. PNFP was in 15 hedge funds’ portfolios at the end of December. There were 13 hedge funds in our database with PNFP holdings at the end of the previous quarter. Our calculations also showed that PNFP isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are plenty of metrics investors employ to value stocks. A duo of the less known metrics are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the elite money managers can outclass the S&P 500 by a significant amount (see the details here).

Let’s view the fresh hedge fund action surrounding Pinnacle Financial Partners, Inc. (NASDAQ:PNFP).

How have hedgies been trading Pinnacle Financial Partners, Inc. (NASDAQ:PNFP)?

At Q4’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in PNFP a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, 12th Street Asset Management held the most valuable stake in Pinnacle Financial Partners, Inc. (NASDAQ:PNFP), which was worth $19.8 million at the end of the third quarter. On the second spot was Point72 Asset Management which amassed $18.9 million worth of shares. Moreover, Mendon Capital Advisors, Forest Hill Capital, and Elizabeth Park Capital Management were also bullish on Pinnacle Financial Partners, Inc. (NASDAQ:PNFP), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names were breaking ground themselves. Point72 Asset Management, managed by Steve Cohen, established the largest position in Pinnacle Financial Partners, Inc. (NASDAQ:PNFP). Point72 Asset Management had $18.9 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $7.7 million position during the quarter. The following funds were also among the new PNFP investors: Ken Griffin’s Citadel Investment Group and Jim Simons’s Renaissance Technologies.

Let’s also examine hedge fund activity in other stocks similar to Pinnacle Financial Partners, Inc. (NASDAQ:PNFP). We will take a look at Selective Insurance Group, Inc. (NASDAQ:SIGI), Rayonier Inc. (NYSE:RYN), PS Business Parks Inc (NYSE:PSB), and CACI International Inc (NYSE:CACI). This group of stocks’ market valuations are closest to PNFP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIGI | 14 | 26205 | 4 |

| RYN | 19 | 292652 | 2 |

| PSB | 12 | 72120 | 6 |

| CACI | 18 | 122971 | -2 |

| Average | 15.75 | 128487 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $128 million. That figure was $124 million in PNFP’s case. Rayonier Inc. (NYSE:RYN) is the most popular stock in this table. On the other hand PS Business Parks Inc (NYSE:PSB) is the least popular one with only 12 bullish hedge fund positions. Pinnacle Financial Partners, Inc. (NASDAQ:PNFP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on PNFP, though not to the same extent, as the stock returned 20.4% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.