Insider Monkey finished processing more than 700 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2018. In this article we are going to take a look at smart money sentiment towards Piedmont Office Realty Trust, Inc. (NYSE:PDM).

Piedmont Office Realty Trust, Inc. (NYSE:PDM) has seen an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that PDM isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are viewed as worthless, old financial tools of years past. While there are more than 8000 funds with their doors open at present, Our experts hone in on the moguls of this group, approximately 750 funds. Most estimates calculate that this group of people command the majority of all hedge funds’ total capital, and by following their highest performing equity investments, Insider Monkey has found numerous investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a peek at the recent hedge fund action surrounding Piedmont Office Realty Trust, Inc. (NYSE:PDM).

What have hedge funds been doing with Piedmont Office Realty Trust, Inc. (NYSE:PDM)?

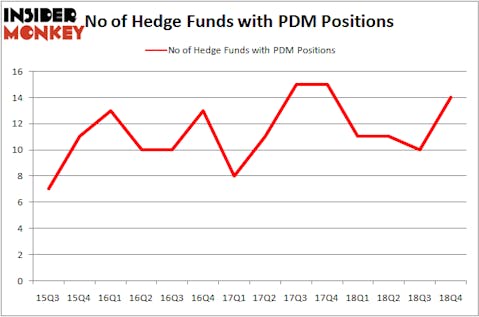

Heading into the first quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 40% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in PDM over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Piedmont Office Realty Trust, Inc. (NYSE:PDM), which was worth $54 million at the end of the third quarter. On the second spot was AEW Capital Management which amassed $49.2 million worth of shares. Moreover, GLG Partners, Citadel Investment Group, and D E Shaw were also bullish on Piedmont Office Realty Trust, Inc. (NYSE:PDM), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers have been driving this bullishness. Balyasny Asset Management, managed by Dmitry Balyasny, established the most valuable position in Piedmont Office Realty Trust, Inc. (NYSE:PDM). Balyasny Asset Management had $0.9 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also initiated a $0.9 million position during the quarter. The following funds were also among the new PDM investors: David Costen Haley’s HBK Investments, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Michael Gelband’s ExodusPoint Capital.

Let’s now review hedge fund activity in other stocks similar to Piedmont Office Realty Trust, Inc. (NYSE:PDM). We will take a look at Pandora Media Inc (NYSE:P), Legg Mason, Inc. (NYSE:LM), Tandem Diabetes Care Inc (NASDAQ:TNDM), and Washington Federal Inc. (NASDAQ:WAFD). All of these stocks’ market caps match PDM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| P | 39 | 779833 | -2 |

| LM | 18 | 120211 | -2 |

| TNDM | 25 | 373698 | 3 |

| WAFD | 12 | 76775 | -1 |

| Average | 23.5 | 337629 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $338 million. That figure was $118 million in PDM’s case. Pandora Media Inc (NYSE:P) is the most popular stock in this table. On the other hand Washington Federal Inc. (NASDAQ:WAFD) is the least popular one with only 12 bullish hedge fund positions. Piedmont Office Realty Trust, Inc. (NYSE:PDM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on PDM, though not to the same extent, as the stock returned 19.3% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.