At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not PennantPark Investment Corp. (NASDAQ:PNNT) makes for a good investment right now.

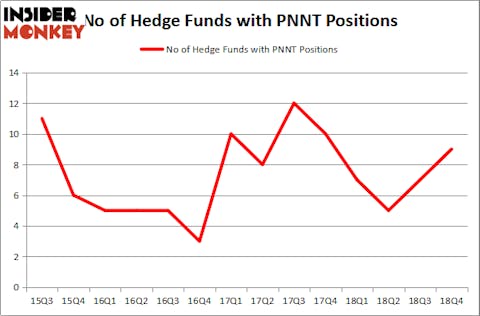

Is PennantPark Investment Corp. (NASDAQ:PNNT) a great investment today? Investors who are in the know are turning bullish. The number of long hedge fund bets inched up by 2 lately. Our calculations also showed that PNNT isn’t among the 30 most popular stocks among hedge funds. PNNT was in 9 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 7 hedge funds in our database with PNNT positions at the end of the previous quarter.

According to most shareholders, hedge funds are viewed as unimportant, old financial vehicles of yesteryear. While there are greater than 8000 funds with their doors open at present, Our researchers choose to focus on the upper echelon of this club, approximately 750 funds. These hedge fund managers oversee bulk of all hedge funds’ total asset base, and by keeping an eye on their first-class stock picks, Insider Monkey has spotted a few investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to check out the fresh hedge fund action surrounding PennantPark Investment Corp. (NASDAQ:PNNT).

Hedge fund activity in PennantPark Investment Corp. (NASDAQ:PNNT)

Heading into the first quarter of 2019, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 29% from one quarter earlier. By comparison, 7 hedge funds held shares or bullish call options in PNNT a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

More specifically, Arrowstreet Capital was the largest shareholder of PennantPark Investment Corp. (NASDAQ:PNNT), with a stake worth $4.6 million reported as of the end of December. Trailing Arrowstreet Capital was Millennium Management, which amassed a stake valued at $3 million. Two Sigma Advisors, McKinley Capital Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, specific money managers have been driving this bullishness. Citadel Investment Group, managed by Ken Griffin, initiated the most outsized position in PennantPark Investment Corp. (NASDAQ:PNNT). Citadel Investment Group had $0.6 million invested in the company at the end of the quarter. Frederick DiSanto’s Ancora Advisors also initiated a $0.2 million position during the quarter. The other funds with new positions in the stock are Michael Platt and William Reeves’s BlueCrest Capital Mgmt. and Michael Gelband’s ExodusPoint Capital.

Let’s now take a look at hedge fund activity in other stocks similar to PennantPark Investment Corp. (NASDAQ:PNNT). These stocks are United Community Financial Corp (NASDAQ:UCFC), Hawkins, Inc. (NASDAQ:HWKN), New Gold Inc. (NYSEAMEX:NGD), and Overstock.com, Inc. (NASDAQ:OSTK). This group of stocks’ market caps match PNNT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UCFC | 8 | 30776 | 0 |

| HWKN | 9 | 8181 | 0 |

| NGD | 15 | 42598 | 1 |

| OSTK | 10 | 20369 | -6 |

| Average | 10.5 | 25481 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $25 million. That figure was $13 million in PNNT’s case. New Gold Inc. (NYSEAMEX:NGD) is the most popular stock in this table. On the other hand United Community Financial Corp (NASDAQ:UCFC) is the least popular one with only 8 bullish hedge fund positions. PennantPark Investment Corp. (NASDAQ:PNNT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately PNNT wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); PNNT investors were disappointed as the stock returned 13.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.