Is PagSeguro Digital Ltd. (NYSE:PAGS) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

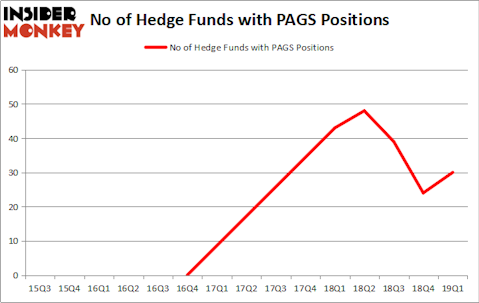

PagSeguro Digital Ltd. (NYSE:PAGS) shareholders have witnessed an increase in hedge fund sentiment recently. PAGS was in 30 hedge funds’ portfolios at the end of March. There were 24 hedge funds in our database with PAGS positions at the end of the previous quarter. Our calculations also showed that PAGS isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are assumed to be worthless, old financial vehicles of yesteryear. While there are over 8000 funds with their doors open at present, Our researchers look at the aristocrats of this club, around 750 funds. These money managers direct the majority of all hedge funds’ total capital, and by tailing their first-class equity investments, Insider Monkey has deciphered many investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a peek at the latest hedge fund action surrounding PagSeguro Digital Ltd. (NYSE:PAGS).

What does the smart money think about PagSeguro Digital Ltd. (NYSE:PAGS)?

At the end of the first quarter, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PAGS over the last 15 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Melvin Capital Management, managed by Gabriel Plotkin, holds the largest position in PagSeguro Digital Ltd. (NYSE:PAGS). Melvin Capital Management has a $300.3 million position in the stock, comprising 3.5% of its 13F portfolio. The second most bullish fund manager is Daniel Patrick Gibson of Sylebra Capital Management, with a $215.4 million position; the fund has 12.7% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism encompass Dennis Puri and Oliver Keller’s Hunt Lane Capital, Robert Pitts’s Steadfast Capital Management and Christopher R. Hansen’s Valiant Capital.

Consequently, specific money managers have jumped into PagSeguro Digital Ltd. (NYSE:PAGS) headfirst. Capital Growth Management, managed by Ken Heebner, established the biggest position in PagSeguro Digital Ltd. (NYSE:PAGS). Capital Growth Management had $40.7 million invested in the company at the end of the quarter. Alex Sacerdote’s Whale Rock Capital Management also initiated a $40.1 million position during the quarter. The other funds with brand new PAGS positions are Richard Driehaus’s Driehaus Capital, Jeffrey Hoffner’s Engle Capital, and Eli Cohen’s Crescent Park Management.

Let’s now take a look at hedge fund activity in other stocks similar to PagSeguro Digital Ltd. (NYSE:PAGS). These stocks are 58.com Inc (NYSE:WUBA), Sea Limited (NYSE:SE), Spirit AeroSystems Holdings, Inc. (NYSE:SPR), and AGNC Investment Corp. (NASDAQ:AGNC). This group of stocks’ market values are similar to PAGS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WUBA | 24 | 528862 | 1 |

| SE | 50 | 2178777 | 36 |

| SPR | 29 | 2186164 | -3 |

| AGNC | 15 | 233055 | -6 |

| Average | 29.5 | 1281715 | 7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $1282 million. That figure was $1280 million in PAGS’s case. Sea Limited (NYSE:SE) is the most popular stock in this table. On the other hand AGNC Investment Corp. (NASDAQ:AGNC) is the least popular one with only 15 bullish hedge fund positions. PagSeguro Digital Ltd. (NYSE:PAGS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on PAGS as the stock returned 9.8% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.