The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on December 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Pacific Premier Bancorp, Inc. (NASDAQ:PPBI) based on those filings.

Hedge fund interest in Pacific Premier Bancorp, Inc. (NASDAQ:PPBI) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Grupo Simec S.A.B. de C.V. (NYSEAMEX:SIM), M.D.C. Holdings, Inc. (NYSE:MDC), and BEST Inc. (NYSE:BSTI) to gather more data points.

At the moment there are a lot of tools market participants employ to evaluate their holdings. A couple of the less known tools are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the top investment managers can outclass the broader indices by a superb margin (see the details here).

We’re going to take a glance at the key hedge fund action surrounding Pacific Premier Bancorp, Inc. (NASDAQ:PPBI).

What have hedge funds been doing with Pacific Premier Bancorp, Inc. (NASDAQ:PPBI)?

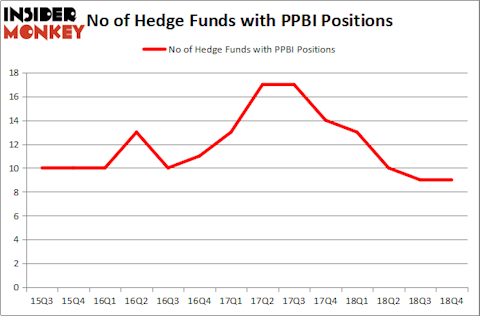

Heading into the first quarter of 2019, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in PPBI over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Cardinal Capital held the most valuable stake in Pacific Premier Bancorp, Inc. (NASDAQ:PPBI), which was worth $38.6 million at the end of the fourth quarter. On the second spot was Millennium Management which amassed $13.2 million worth of shares. Moreover, Basswood Capital, Polar Capital, and GLG Partners were also bullish on Pacific Premier Bancorp, Inc. (NASDAQ:PPBI), allocating a large percentage of their portfolios to this stock.

Since Pacific Premier Bancorp, Inc. (NASDAQ:PPBI) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there were a few fund managers that slashed their positions entirely by the end of the third quarter. Interestingly, Anton Schutz’s Mendon Capital Advisors sold off the biggest investment of all the hedgies tracked by Insider Monkey, valued at about $7.5 million in stock, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt. was right behind this move, as the fund said goodbye to about $1.6 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Pacific Premier Bancorp, Inc. (NASDAQ:PPBI) but similarly valued. We will take a look at Grupo Simec S.A.B. de C.V. (NYSEAMEX:SIM), M.D.C. Holdings, Inc. (NYSE:MDC), BEST Inc. (NYSE:BSTI), and Hudson Ltd. (NYSE:HUD). This group of stocks’ market caps resemble PPBI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIM | 1 | 2346 | 0 |

| MDC | 16 | 107711 | 5 |

| BSTI | 9 | 37305 | -3 |

| HUD | 12 | 53652 | -8 |

| Average | 9.5 | 50254 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $50 million. That figure was $69 million in PPBI’s case. M.D.C. Holdings, Inc. (NYSE:MDC) is the most popular stock in this table. On the other hand Grupo Simec S.A.B. de C.V. (NYSEAMEX:SIM) is the least popular one with only 1 bullish hedge fund positions. Pacific Premier Bancorp, Inc. (NASDAQ:PPBI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately PPBI wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); PPBI investors were disappointed as the stock returned 12.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.