Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Otter Tail Corporation (NASDAQ:OTTR) to find out whether it was one of their high conviction long-term ideas.

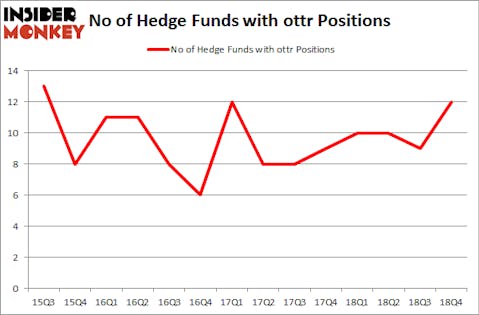

Otter Tail Corporation (NASDAQ:OTTR) has experienced an increase in enthusiasm from smart money of late. OTTR was in 12 hedge funds’ portfolios at the end of December. There were 9 hedge funds in our database with OTTR positions at the end of the previous quarter. Our calculations also showed that ottr isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the new hedge fund action surrounding Otter Tail Corporation (NASDAQ:OTTR).

Hedge fund activity in Otter Tail Corporation (NASDAQ:OTTR)

Heading into the first quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in OTTR a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Otter Tail Corporation (NASDAQ:OTTR), which was worth $47.4 million at the end of the third quarter. On the second spot was GAMCO Investors which amassed $18.4 million worth of shares. Moreover, Millennium Management, Blue Mountain Capital, and Zebra Capital Management were also bullish on Otter Tail Corporation (NASDAQ:OTTR), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers have been driving this bullishness. Holocene Advisors, managed by Brandon Haley, initiated the biggest position in Otter Tail Corporation (NASDAQ:OTTR). Holocene Advisors had $0.4 million invested in the company at the end of the quarter. Peter Algert and Kevin Coldiron’s Algert Coldiron Investors also made a $0.4 million investment in the stock during the quarter. The only other fund with a new position in the stock is Ronald Hua’s Qtron Investments.

Let’s now take a look at hedge fund activity in other stocks similar to Otter Tail Corporation (NASDAQ:OTTR). We will take a look at MyoKardia, Inc. (NASDAQ:MYOK), Zuora, Inc. (NYSE:ZUO), PDC Energy Inc (NASDAQ:PDCE), and Atlantica Yield plc (NASDAQ:AY). This group of stocks’ market caps are closest to OTTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MYOK | 22 | 481719 | 0 |

| ZUO | 14 | 69393 | -1 |

| PDCE | 16 | 278321 | -3 |

| AY | 22 | 325334 | 2 |

| Average | 18.5 | 288692 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $289 million. That figure was $71 million in OTTR’s case. MyoKardia, Inc. (NASDAQ:MYOK) is the most popular stock in this table. On the other hand Zuora, Inc. (NYSE:ZUO) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Otter Tail Corporation (NASDAQ:OTTR) is even less popular than ZUO. Hedge funds dodged a bullet by taking a bearish stance towards OTTR. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately OTTR wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); OTTR investors were disappointed as the stock returned 1.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.