Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

Is Ormat Technologies, Inc. (NYSE:ORA) an exceptional stock to buy now? Money managers are getting less optimistic. The number of long hedge fund positions dropped by 2 in recent months. Our calculations also showed that ora isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the new hedge fund action encompassing Ormat Technologies, Inc. (NYSE:ORA).

What have hedge funds been doing with Ormat Technologies, Inc. (NYSE:ORA)?

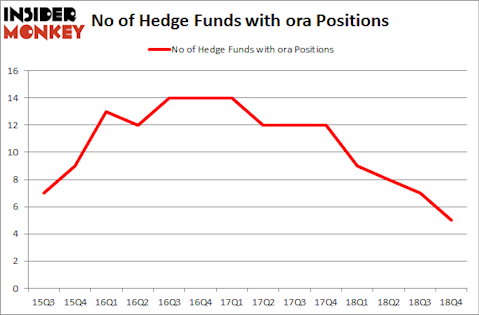

Heading into the first quarter of 2019, a total of 5 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -29% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ORA over the last 14 quarters. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Impax Asset Management, managed by Ian Simm, holds the most valuable position in Ormat Technologies, Inc. (NYSE:ORA). Impax Asset Management has a $91.8 million position in the stock, comprising 1.5% of its 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, managed by Jim Simons, which holds a $52 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism include Mario Gabelli’s GAMCO Investors, Brandon Haley’s Holocene Advisors and Ken Griffin’s Citadel Investment Group.

Because Ormat Technologies, Inc. (NYSE:ORA) has faced bearish sentiment from the smart money, it’s easy to see that there is a sect of hedgies that elected to cut their full holdings last quarter. Intriguingly, Roger Ibbotson’s Zebra Capital Management dropped the biggest stake of the 700 funds followed by Insider Monkey, comprising about $0.6 million in stock. Noam Gottesman’s fund, GLG Partners, also cut its stock, about $0.3 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 2 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Ormat Technologies, Inc. (NYSE:ORA). We will take a look at Guangshen Railway Co. Ltd (NYSE:GSH), Steven Madden, Ltd. (NASDAQ:SHOO), Cyberark Software Ltd (NASDAQ:CYBR), and Exponent, Inc. (NASDAQ:EXPO). All of these stocks’ market caps resemble ORA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GSH | 1 | 3837 | 0 |

| SHOO | 18 | 63767 | 3 |

| CYBR | 20 | 271680 | -4 |

| EXPO | 16 | 115214 | 4 |

| Average | 13.75 | 113625 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $114 million. That figure was $149 million in ORA’s case. Cyberark Software Ltd (NASDAQ:CYBR) is the most popular stock in this table. On the other hand Guangshen Railway Co. Ltd (NYSE:GSH) is the least popular one with only 1 bullish hedge fund positions. Ormat Technologies, Inc. (NYSE:ORA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ORA wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); ORA investors were disappointed as the stock returned 9.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.