Is OGE Energy Corp. (NYSE:OGE) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

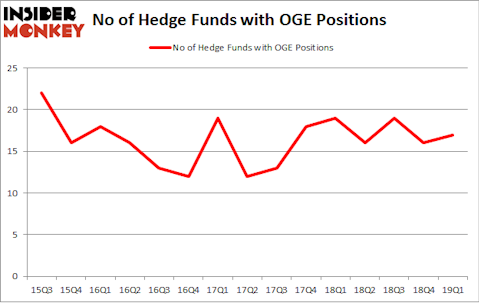

OGE Energy Corp. (NYSE:OGE) was in 17 hedge funds’ portfolios at the end of March. OGE investors should pay attention to an increase in activity from the world’s largest hedge funds of late. There were 16 hedge funds in our database with OGE positions at the end of the previous quarter. Our calculations also showed that oge isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are seen as underperforming, outdated financial tools of yesteryear. While there are more than 8000 funds trading at present, Our researchers choose to focus on the bigwigs of this group, about 750 funds. Most estimates calculate that this group of people preside over bulk of the smart money’s total asset base, and by keeping track of their best picks, Insider Monkey has unearthed a number of investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s take a look at the latest hedge fund action surrounding OGE Energy Corp. (NYSE:OGE).

How are hedge funds trading OGE Energy Corp. (NYSE:OGE)?

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the previous quarter. On the other hand, there were a total of 19 hedge funds with a bullish position in OGE a year ago. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in OGE Energy Corp. (NYSE:OGE) was held by Renaissance Technologies, which reported holding $77 million worth of stock at the end of March. It was followed by AQR Capital Management with a $64.5 million position. Other investors bullish on the company included Millennium Management, Adage Capital Management, and GLG Partners.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the most valuable position in OGE Energy Corp. (NYSE:OGE). Arrowstreet Capital had $6.3 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $2.8 million position during the quarter. The only other fund with a new position in the stock is Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks similar to OGE Energy Corp. (NYSE:OGE). We will take a look at American Financial Group, Inc. (NYSE:AFG), Teledyne Technologies Incorporated (NYSE:TDY), Pearson PLC (NYSE:PSO), and Allegion plc (NYSE:ALLE). This group of stocks’ market values are closest to OGE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFG | 30 | 316813 | 1 |

| TDY | 28 | 596871 | 8 |

| PSO | 4 | 13571 | -1 |

| ALLE | 21 | 496364 | -4 |

| Average | 20.75 | 355905 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $356 million. That figure was $266 million in OGE’s case. American Financial Group, Inc. (NYSE:AFG) is the most popular stock in this table. On the other hand Pearson PLC (NYSE:PSO) is the least popular one with only 4 bullish hedge fund positions. OGE Energy Corp. (NYSE:OGE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately OGE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); OGE investors were disappointed as the stock returned 0.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.