Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

NCI Building Systems, Inc. (NYSE:NCS) investors should be aware of a decrease in hedge fund interest in recent months. Our calculations also showed that ncs isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are assumed to be worthless, outdated investment vehicles of the past. While there are greater than 8000 funds with their doors open at the moment, We look at the leaders of this club, about 750 funds. These hedge fund managers watch over bulk of all hedge funds’ total capital, and by watching their unrivaled investments, Insider Monkey has found several investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to check out the latest hedge fund action surrounding NCI Building Systems, Inc. (NYSE:NCS).

How are hedge funds trading NCI Building Systems, Inc. (NYSE:NCS)?

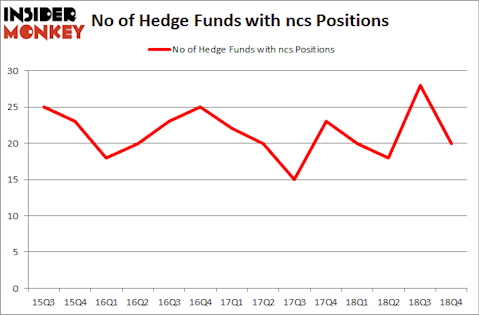

Heading into the first quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -29% from one quarter earlier. On the other hand, there were a total of 20 hedge funds with a bullish position in NCS a year ago. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of NCI Building Systems, Inc. (NYSE:NCS), with a stake worth $25.4 million reported as of the end of December. Trailing Renaissance Technologies was AQR Capital Management, which amassed a stake valued at $7.9 million. Marshall Wace LLP, Prescott Group Capital Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that NCI Building Systems, Inc. (NYSE:NCS) has experienced declining sentiment from the smart money, we can see that there was a specific group of hedgies that slashed their full holdings in the third quarter. It’s worth mentioning that Peter Schliemann’s Rutabaga Capital Management said goodbye to the biggest stake of the 700 funds followed by Insider Monkey, valued at close to $12.3 million in stock, and Bradley Louis Radoff’s Fondren Management was right behind this move, as the fund dropped about $1.7 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest fell by 8 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as NCI Building Systems, Inc. (NYSE:NCS) but similarly valued. These stocks are Coeur Mining, Inc. (NYSE:CDE), Third Point Reinsurance Ltd (NYSE:TPRE), Scorpio Tankers Inc. (NYSE:STNG), and Alamo Group, Inc. (NYSE:ALG). All of these stocks’ market caps are closest to NCS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDE | 13 | 44363 | 0 |

| TPRE | 18 | 52264 | 4 |

| STNG | 10 | 82830 | -4 |

| ALG | 12 | 158978 | -1 |

| Average | 13.25 | 84609 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $85 million. That figure was $75 million in NCS’s case. Third Point Reinsurance Ltd (NYSE:TPRE) is the most popular stock in this table. On the other hand Scorpio Tankers Inc. (NYSE:STNG) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks NCI Building Systems, Inc. (NYSE:NCS) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately NCS wasn’t nearly as popular as these 15 stock and hedge funds that were betting on NCS were disappointed as the stock returned -23.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.