A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended December 31, so let’s proceed with the discussion of the hedge fund sentiment on National Beverage Corp. (NASDAQ:FIZZ).

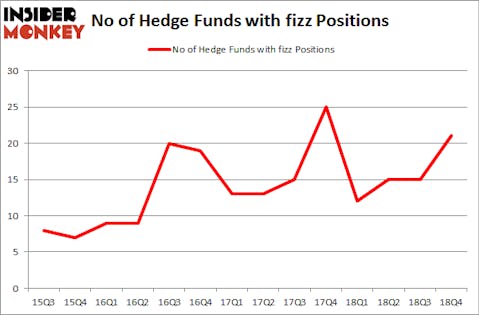

Is National Beverage Corp. (NASDAQ:FIZZ) undervalued? Investors who are in the know are getting more bullish. The number of long hedge fund bets moved up by 6 recently. Our calculations also showed that fizz isn’t among the 30 most popular stocks among hedge funds. FIZZ was in 21 hedge funds’ portfolios at the end of December. There were 15 hedge funds in our database with FIZZ holdings at the end of the previous quarter.

To the average investor there are a large number of gauges investors have at their disposal to assess their holdings. Two of the less known gauges are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can beat the market by a solid amount (see the details here).

Let’s take a glance at the recent hedge fund action encompassing National Beverage Corp. (NASDAQ:FIZZ).

How are hedge funds trading National Beverage Corp. (NASDAQ:FIZZ)?

At the end of the fourth quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 40% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FIZZ over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in National Beverage Corp. (NASDAQ:FIZZ), which was worth $166.3 million at the end of the third quarter. On the second spot was Woodson Capital Management which amassed $20.3 million worth of shares. Moreover, GAMCO Investors, GLG Partners, and Arrowstreet Capital were also bullish on National Beverage Corp. (NASDAQ:FIZZ), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Millennium Management, managed by Israel Englander, assembled the largest position in National Beverage Corp. (NASDAQ:FIZZ). Millennium Management had $8.8 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $5.9 million position during the quarter. The following funds were also among the new FIZZ investors: Matthew Hulsizer’s PEAK6 Capital Management, Matthew Tewksbury’s Stevens Capital Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s now review hedge fund activity in other stocks similar to National Beverage Corp. (NASDAQ:FIZZ). We will take a look at Roku, Inc. (NASDAQ:ROKU), MB Financial, Inc. (NASDAQ:MBFI), Clearway Energy, Inc. (NYSE:CWEN), and Chimera Investment Corporation (NYSE:CIM). This group of stocks’ market valuations match FIZZ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROKU | 26 | 126428 | -5 |

| MBFI | 18 | 190649 | 5 |

| CWEN | 12 | 90190 | -4 |

| CIM | 11 | 29852 | -1 |

| Average | 16.75 | 109280 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $109 million. That figure was $265 million in FIZZ’s case. Roku, Inc. (NASDAQ:ROKU) is the most popular stock in this table. On the other hand Chimera Investment Corporation (NYSE:CIM) is the least popular one with only 11 bullish hedge fund positions. National Beverage Corp. (NASDAQ:FIZZ) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FIZZ wasn’t nearly as popular as these 15 stock and hedge funds that were betting on FIZZ were disappointed as the stock returned -24.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.