Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 15 S&P 500 stocks among hedge funds at the end of December 2018 yielded an average return of 19.7% year-to-date, vs. a gain of 13.1% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Myovant Sciences Ltd. (NYSE:MYOV).

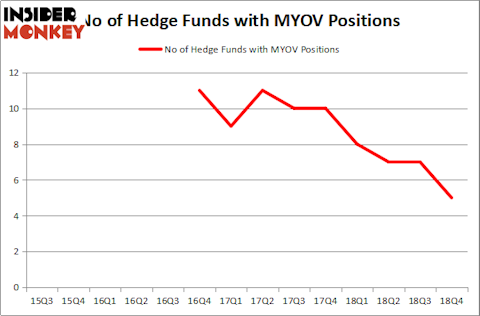

Is Myovant Sciences Ltd. (NYSE:MYOV) a cheap stock to buy now? Hedge funds are becoming less confident. The number of long hedge fund positions were trimmed by 2 in recent months. Our calculations also showed that MYOV isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are tons of signals market participants employ to value their holdings. A couple of the most underrated signals are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can outclass their index-focused peers by a healthy margin (see the details here).

We’re going to go over the latest hedge fund action regarding Myovant Sciences Ltd. (NYSE:MYOV).

How are hedge funds trading Myovant Sciences Ltd. (NYSE:MYOV)?

At the end of the fourth quarter, a total of 5 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -29% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MYOV over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, RA Capital Management, managed by Peter Kolchinsky, holds the biggest position in Myovant Sciences Ltd. (NYSE:MYOV). RA Capital Management has a $60.9 million position in the stock, comprising 3.5% of its 13F portfolio. Coming in second is Phill Gross and Robert Atchinson of Adage Capital Management, with a $11.9 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism include Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Kerr Neilson’s Platinum Asset Management and Israel Englander’s Millennium Management.

Judging by the fact that Myovant Sciences Ltd. (NYSE:MYOV) has faced bearish sentiment from hedge fund managers, it’s safe to say that there is a sect of money managers who sold off their entire stakes in the third quarter. Interestingly, Andrew Weiss’s Weiss Asset Management sold off the biggest stake of the 700 funds monitored by Insider Monkey, totaling close to $0.3 million in stock. Gavin Saitowitz and Cisco J. del Valle’s fund, Springbok Capital, also dropped its stock, about $0.1 million worth. These moves are important to note, as total hedge fund interest fell by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to Myovant Sciences Ltd. (NYSE:MYOV). We will take a look at Ambarella Inc (NASDAQ:AMBA), KKR Real Estate Finance Trust Inc. (NYSE:KREF), LendingClub Corp (NYSE:LC), and The Marcus Corporation (NYSE:MCS). All of these stocks’ market caps are similar to MYOV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMBA | 14 | 74667 | -1 |

| KREF | 8 | 36227 | 0 |

| LC | 7 | 3096 | -2 |

| MCS | 11 | 70912 | -2 |

| Average | 10 | 46226 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $46 million. That figure was $82 million in MYOV’s case. Ambarella Inc (NASDAQ:AMBA) is the most popular stock in this table. On the other hand LendingClub Corp (NYSE:LC) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Myovant Sciences Ltd. (NYSE:MYOV) is even less popular than LC. Hedge funds dodged a bullet by taking a bearish stance towards MYOV. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately MYOV wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); MYOV investors were disappointed as the stock returned 16.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.