At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not MSC Industrial Direct Co Inc (NYSE:MSM) makes for a good investment right now.

Is MSC Industrial Direct Co Inc (NYSE:MSM) a first-rate investment now? Money managers are taking an optimistic view. The number of long hedge fund positions moved up by 2 recently. Our calculations also showed that MSM isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action encompassing MSC Industrial Direct Co Inc (NYSE:MSM).

Hedge fund activity in MSC Industrial Direct Co Inc (NYSE:MSM)

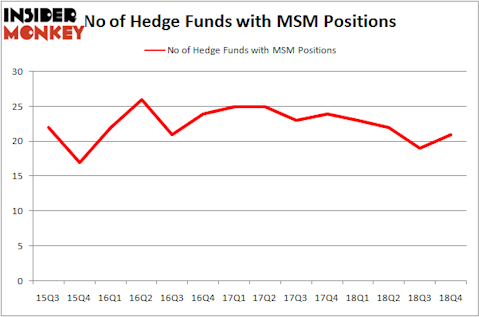

At Q4’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MSM over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Matt Simon (Citadel)’s Ashler Capital has the number one position in MSC Industrial Direct Co Inc (NYSE:MSM), worth close to $50.8 million, comprising 3.8% of its total 13F portfolio. Coming in second is Renaissance Technologies, led by Jim Simons, holding a $26.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism contain Cliff Asness’s AQR Capital Management, D. E. Shaw’s D E Shaw and David Harding’s Winton Capital Management.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Ashler Capital, managed by Matt Simon (Citadel), initiated the most valuable position in MSC Industrial Direct Co Inc (NYSE:MSM). Ashler Capital had $50.8 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $2.3 million investment in the stock during the quarter. The following funds were also among the new MSM investors: Dmitry Balyasny’s Balyasny Asset Management, Ray Dalio’s Bridgewater Associates, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks similar to MSC Industrial Direct Co Inc (NYSE:MSM). We will take a look at Wix.Com Ltd (NASDAQ:WIX), Transocean Ltd (NYSE:RIG), ITT Inc. (NYSE:ITT), and Penumbra Inc (NYSE:PEN). This group of stocks’ market caps are similar to MSM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WIX | 27 | 656048 | 3 |

| RIG | 33 | 755414 | -9 |

| ITT | 25 | 308324 | 6 |

| PEN | 18 | 231703 | -7 |

| Average | 25.75 | 487872 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $488 million. That figure was $170 million in MSM’s case. Transocean Ltd (NYSE:RIG) is the most popular stock in this table. On the other hand Penumbra Inc (NYSE:PEN) is the least popular one with only 18 bullish hedge fund positions. MSC Industrial Direct Co Inc (NYSE:MSM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately MSM wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); MSM investors were disappointed as the stock returned 7.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.