Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and investors’ positions as of the end of the fourth quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Mercantile Bank Corp. (NASDAQ:MBWM) based on that data.

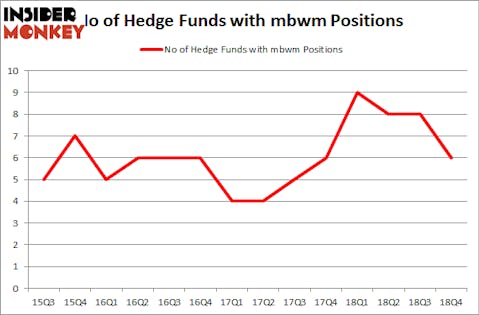

Mercantile Bank Corp. (NASDAQ:MBWM) was in 6 hedge funds’ portfolios at the end of December. MBWM has seen a decrease in hedge fund interest in recent months. There were 8 hedge funds in our database with MBWM holdings at the end of the previous quarter. Our calculations also showed that mbwm isn’t among the 30 most popular stocks among hedge funds.

According to most shareholders, hedge funds are seen as worthless, old financial vehicles of the past. While there are more than 8000 funds in operation at present, Our researchers choose to focus on the upper echelon of this club, approximately 750 funds. These money managers control most of the hedge fund industry’s total capital, and by watching their inimitable investments, Insider Monkey has unsheathed various investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Cliff Asness of AQR Capital Management

We’re going to take a look at the new hedge fund action encompassing Mercantile Bank Corp. (NASDAQ:MBWM).

What does the smart money think about Mercantile Bank Corp. (NASDAQ:MBWM)?

At Q4’s end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from the second quarter of 2018. By comparison, 9 hedge funds held shares or bullish call options in MBWM a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in Mercantile Bank Corp. (NASDAQ:MBWM). Renaissance Technologies has a $21.8 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is Algert Coldiron Investors, managed by Peter Algert and Kevin Coldiron, which holds a $0.8 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other professional money managers that are bullish include Cliff Asness’s AQR Capital Management, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors.

Since Mercantile Bank Corp. (NASDAQ:MBWM) has witnessed falling interest from the entirety of the hedge funds we track, we can see that there was a specific group of money managers who were dropping their positions entirely last quarter. Interestingly, Peter Muller’s PDT Partners said goodbye to the biggest investment of the “upper crust” of funds tracked by Insider Monkey, worth close to $0.4 million in stock. D. E. Shaw’s fund, D E Shaw, also sold off its stock, about $0.3 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 2 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Mercantile Bank Corp. (NASDAQ:MBWM) but similarly valued. These stocks are CymaBay Therapeutics Inc (NASDAQ:CBAY), Front Yard Residential Corporation (NYSE:RESI), Natural Resource Partners LP (NYSE:NRP), and American Public Education, Inc. (NASDAQ:APEI). All of these stocks’ market caps are similar to MBWM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBAY | 27 | 186903 | 4 |

| RESI | 13 | 24911 | -2 |

| NRP | 4 | 8080 | -1 |

| APEI | 16 | 76944 | 3 |

| Average | 15 | 74210 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $74 million. That figure was $25 million in MBWM’s case. CymaBay Therapeutics Inc (NASDAQ:CBAY) is the most popular stock in this table. On the other hand Natural Resource Partners LP (NYSE:NRP) is the least popular one with only 4 bullish hedge fund positions. Mercantile Bank Corp. (NASDAQ:MBWM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on MBWM, though not to the same extent, as the stock returned 17.4% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.